As the Federal Reserve gears up for its highly anticipated monetary policy meeting, the cryptocurrency world is holding steady—particularly Ripple’s XRP. On the heels of the fifth XRP-related Exchange Traded Fund (ETF) launch, anticipation is building in both retail and institutional circles. But while the ETF unveiling is a milestone, it’s the timing of this financial product rollout—locked tightly with a possible interest rate cut and easing Federal Reserve stance—that could reshape XRP’s short-term landscape.

![XRP News [LIVE] Update](https://image.coinpedia.org/wp-content/uploads/2025/12/01124853/How-High-or-Low-Can-XRP-Price-Go-After-Fifth-ETF-Launch-Today-1024x536.webp)

ETF Momentum Meets Federal Reserve Uncertainty

With the fifth XRP-focused ETF introduced to the market today, Ripple Labs is enjoying an institutional tailwind not seen since the SEC’s legal pivot earlier this year. ETFs serve as crucial access points for mainstream and risk-averse investors, and their accumulation suggests growing demand for regulated crypto exposure. That said, investor appetite remains measured as all eyes turn toward tomorrow’s FOMC (Federal Open Market Committee) meeting, where the Fed is widely expected to slash interest rates by 25 basis points.

Historically, rate cuts signal liquidity inflow into risk-on assets—including cryptocurrencies. The Federal Reserve has suggested a dialing down of its quantitative tightening efforts, a policy pivot that could accelerate capital migration into digital markets. XRP stands to benefit disproportionately, not just from increased liquidity but from narrowing uncertainty surrounding its legality and market legitimacy.

Bitcoin’s Sideways Movement Puts a Lid on Altcoin Ambitions

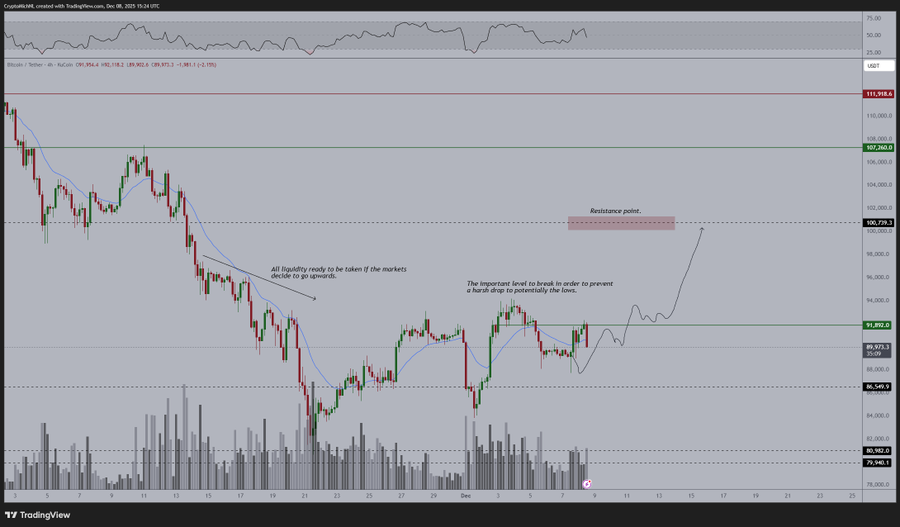

Bitcoin continues to carve out a narrow range between $90,000 and $94,000, showing muted momentum and declining ETF inflows. This indecision at crypto’s top tier often creates a restrictive ceiling for altcoins, and XRP is no exception. Though decoupling narratives occasionally emerge, XRP’s price action remains correlated with BTC’s ability to break—or fail at—key resistance levels.

Dutch analyst Michael van de Poppe described market behavior during FOMC week as “risk-off by default,” warning that Bitcoin could revisit support around $86,000 if pressure dynamically shifts. Traders currently appear less inclined to position ahead of macro signals, particularly in the shadow of a hawkish surprise. Against this backdrop, XRP’s own consolidation becomes more understandable: movement is limited, not due to lack of interest, but intentional hesitation.

XRP’s Compression Pattern Suggests Impending Breakout

Technically, XRP sits below the $2.00 psychological barrier, trading within a narrow band consistent with accumulation zones. Market participants have noted low spot volumes, weak leverage, and minimal directional conviction—signs typical of a market bracing for external catalysts. Importantly, XRP’s chart reveals an unfilled liquidity gap in the $1.96 to $1.98 region, a zone that may attract price before a larger directional move unfolds.

Meanwhile, options open interest in XRP remains elevated, particularly in call strikes between $2.10 and $2.30. This implies that smart money is preparing for upside volatility, potentially betting on a dovish narrative out of the Fed. Yet, this setup only holds if broader market conditions play along.

Fed Outcome Will Decide Whether XRP Clears $2.30 Ceiling

Should the Federal Reserve confirm its dovish lean with a rate cut and hints at ending QT, the entire crypto space could experience a risk-on cycle. In such a scenario, XRP could comfortably clear $2.00 and attempt short-term rallies toward $2.10 and $2.20. However, breaking through the well-defined top of its consolidation range—$2.30—would require more than just a mild relief rally. It would demand a synchronized bullish effort across crypto assets, spearheaded by Bitcoin’s resurgence.

Beyond $2.30: What Would Justify the Next Leg Up?

To see XRP catch momentum beyond $2.30, the market would need to converge around three variables. First, a firm Bitcoin recovery that reestablishes dominance above its $94,000 ceiling. Second, fresh institutional inflows sparked by the newly launched XRP ETF demonstrating real volume traction. And third, a macro environment that not only favors risk but sustains it—something the Fed alone cannot guarantee in one meeting. Without these reinforcing signals, a break above $2.30 may remain elusive.

The Path Ahead: Volatility Is the Only Certainty

As XRP locks into its pre-FOMC structure, the playbook for traders is becoming increasingly binary. A dovish Fed and rising Bitcoin could bring XRP’s resistance levels into play rapidly. Conversely, if the Fed underdelivers or if inflation metrics startle markets, XRP could fall back into the $1.90s, testing earlier support zones before reassessing direction.

With ETF support on one hand and macro risk on the other, XRP’s next chapter will be defined not merely by fundamentals but by the tempo of the financial narrative that shapes them. The market isn’t short on drivers this week—how XRP responds will speak volumes about its staying power in the upper tier of digital assets.