The crypto market is flashing red as Bitcoin, Ethereum, and XRP all tumble under intense selling pressure.

New on-chain data from CryptoQuant reveals a historic collapse in Bitcoin demand, a potential signal that the digital asset’s long-term uptrend has hit a critical juncture. With stock market weakness adding fuel to the fire, the downward momentum is building across the board—leaving analysts and investors retracing new zones of support and asking how low prices could go in the coming weeks.

CryptoQuant Flags Alarming Decline in Bitcoin Demand

According to CryptoQuant, institutional and retail interest in Bitcoin has dropped to multi-month lows, with demand metrics falling beneath 2024 averages. This decline is particularly evident on the major exchanges, where net inflows have reversed into sustained outflows—typically a sign of investors retreating to the sidelines or panic selling into cash.

More concerning is the simultaneous drop in Bitcoin’s network activity. The number of active addresses and transactions per day—a rough proxy for real-world usage—continues to decline. Historically, such slumps in demand, especially when paired with broad market weakness, have served as early indicators for protracted price corrections.

Stock Market Correlation Amplifies Risk

Adding weight to the bearish outlook is the reawakening volatility in U.S. equities. The S&P 500 declined sharply on Monday, with tech stocks leading the losses amid hawkish Fed rhetoric and renewed inflation fears. Given how tightly correlated cryptocurrencies have become with risk-on assets, these equity jitters are directly pressuring the digital asset market.

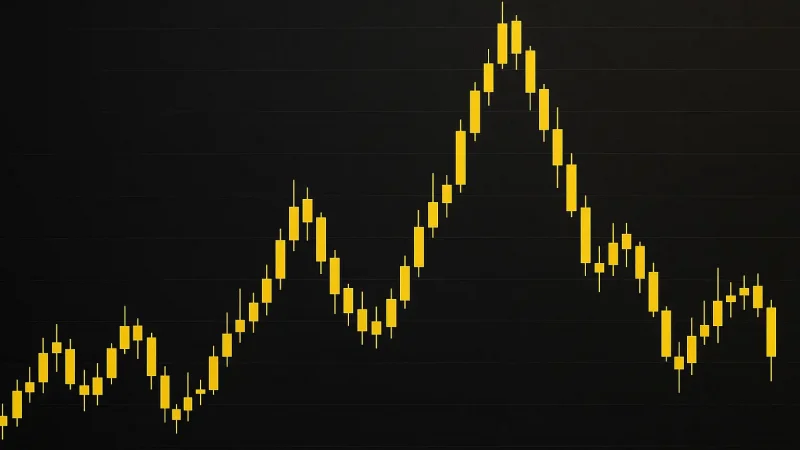

For Bitcoin in particular, the timing couldn’t be worse. After failing to break through its resistance band around $92,000–$94,000, the asset has slipped into a technically fragile zone near $85,000. If this support breaks with conviction, a broader capitulation to the low-$80K or even $70K levels could follow—exacerbated by forced liquidations and evaporating demand.

Altcoins Suffer as Contagion Spreads

Ethereum and XRP are not immune to the breakdown, with both major altcoins showing signs of deteriorating structure on daily and weekly charts. In Ethereum’s case, losing the psychological $3,000 floor has triggered aggressive selling, and signals derived from moving average crossovers and RSI divergence suggest downside potential toward $2,600 or even $2,500.

XRP, meanwhile, is teetering on a cliff. Long considered a laggard among large-cap coins, it is now testing its final major support band around $1.80–$2.00. If that breaks on a weekly close, traders anticipate a swift plunge down to $1.40 or lower, with little in the way of structural support to cushion the drop. On-chain data suggests long-term holders are beginning to exit, a behavior that historically precedes multiple-month drawdowns.

Bitcoin Price Levels to Watch

Analysts across Glassnode, CryptoQuant, and independent trading desks are in rare agreement: Bitcoin is sitting on thin ice. The key zones to monitor include:

- $85,000 – Critical near-term support. A close below may trigger swift downside.

- $80,000 – Psychological support with modest historical buying interest.

- $74,000–$76,000 – A confluence area flagged by multiple long-term Fibonacci retracement models.

- $70,000 – Some technical bear flags indicate downside risk may stretch this far over Q3.

Investor Sentiment Turns Defensive

The mood in the crypto community has visibly shifted. Traders on X (formerly Twitter) and Reddit’s r/CryptoCurrency have begun adjusting their targets downward, with many moving to the sidelines or hedging spot positions using derivatives. Open interest on crypto futures platforms has plummeted, and major market makers are reducing their quote width—both signs of dwindling liquidity and risk appetite.

Institutional players like Grayscale and Coinbase Prime are also reportedly tightening client exposure limits, especially to altcoins. Combined with falling retail demand and negative funding rates, it suggests this drawdown may evolve beyond a short-term correction and into a medium-cycle bear phase.

Still, some see opportunity in panic. “Capitulation breeds generational entries,” notes Alex Thorn of Galaxy Digital. “This is when the smart money lays its foundation.”

Looking Ahead: Capitulation or Consolidation?

Whether this is the final leg of a cleansingly brutal correction or the first chapter of a longer winter remains unknown. What’s clear is that the crypto market’s structural narrative—once powered by increasing institutional adoption, ETF optimism, and on-chain development—appears to have paused, at least temporarily.

For now, analysts encourage caution: let the charts breathe, the leverage flush, and demand structures rebuild. Only then may crypto prepare for its next leg up—from weathering panic to building resilience.