As whispers of an impending bull run stir excitement across the crypto landscape, seasoned investors and newcomers alike are actively reshuffling their portfolios. With market sentiment gradually turning bullish, traders are once again hunting for assets with the potential to outperform. Among a sea of altcoins and megacaps, three cryptocurrencies — XRP, Dogecoin (DOGE), and the emerging Mutuum Finance (MUTM) — are surging to the surface based on strategic developments, community energy, and asymmetrical upside potential.

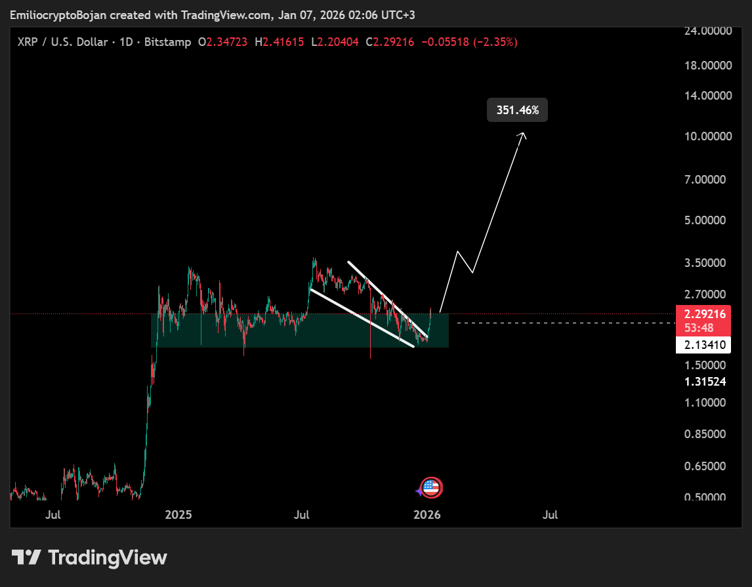

XRP Gains Institutional Ground Amid Regulatory Progress

XRP has evolved from a regulatory punching bag into a maturing digital asset embraced by legacy finance. In 2025, the U.S. SEC’s dropped case against Ripple Labs opened the door to wider institutional participation. Major exchanges reinstated XRP trading, and ETF issuers moved swiftly — with the first XRP-backed exchange-traded fund quietly exceeding $1 billion in assets under management within its first two quarters.

Beyond Wall Street, XRP’s strategic alignment with central banks is perhaps more telling of its long-term trajectory. Through its integration with the Wormhole protocol and partnerships in over 20 central bank digital currency (CBDC) pilots globally, XRP is positioned as a universal bridge asset for cross-border payments. This narrative of utility and legitimacy is reframing XRP’s appeal from speculative to strategic, even if the upside is expected to be gradual compared to newer tokens.

Dogecoin Rebounds on Hype and High Timeframe Signals

Dogecoin, the ever-charismatic meme token, has returned to the headlines after completing a rare higher high on the daily time frame. Now trading above $0.14 for the first time in months, DOGE is signaling bullish intent. Technical traders are monitoring 14, 21, and 35 SMA stacks for confirmation, while resistance clusters at $0.16 and $0.18 gate potential continuation.

Although DOGE’s momentum appears promising, its fundamentals remain thin. Sentiment and social media catalyze most of its rallies — historically accelerated by endorsements from Elon Musk or community flash mobs. Its value proposition still revolves around culture more than computation. That said, in periods of meme coin fervor, DOGE thrives as a cycle-driven asset, capable of doubling before fundamentals catch up. However, investors seeking durable upside may look to emerging tokens offering both momentum and utility.

Mutuum Finance: Undervalued DeFi Infrastructure With High ROI Potential

Born at the intersection of decentralized lending and tokenomics engineering, Mutuum Finance (MUTM) is quietly staging one of the most aggressive early-stage runs of the cycle. Currently deep into Presale Phase 7 at $0.04, MUTM has already returned 300% gains since its initial $0.01 price. With nearly $20 million raised from over 15,000 token holders worldwide, the protocol is moving quickly but deliberately.

What sets MUTM apart is its hybridized DeFi design — a protocol enabling borrowers to unlock liquidity against crypto collateral without liquidating, akin to what Aave or Maker once pioneered. For retail users, this represents the ability to stay long on assets like ETH while deploying capital for other gains. For deeper-pocketed investors, it creates complex repositioning opportunities. Early projections suggest a listing at $0.06, but analysts posit $0.50+ could be on the table months after launch — signaling a 12x return for Phase 7 investors.

Real-World Utility: Borrowing and Earning Without Selling

Core to Mutuum’s engineering is the ability to borrow against held cryptocurrencies using structured LTV (loan-to-value) models. For instance, users can lock $15,000 in Ethereum and receive $11,250 in stablecoins based on a 75% LTV — effectively accessing cash flow without triggering taxable events or selling.

This capital efficiency marks a stark contrast to passive holding or yield farming. It also suggests a deeper layer of adoption potential for MUTM across crypto-savvy audiences who are increasingly seeking to optimize idle assets without giving away exposure to upside swings. This functional DeFi utility gives MUTM weight as an infrastructure token, not just a speculative memo.

Gamified Community Incentives Fuel Holder Expansion

Beyond protocol utility, Mutuum has tapped into behavioral finance with a series of viral incentives engineered to create urgency. A $100,000 giveaway — rewarding ten participants with $10,000 in MUTM — has taken over Web3 social spaces, while a daily top-buyer leaderboard rewards the most active purchasers with $500 bonuses.

These programs aren’t just marketing noise. They’re seeding a robust, engaged holder base that interacts with the presale and strengthens the post-launch ecosystem. In a market where user-owned network effects matter more than roadmaps, Mutuum’s high-velocity strategy is working. The token’s rising supply-demand imbalance amid expanding adoption mirrors classic DeFi success stories from 2020 to 2022 — except it’s unfolding with clearer structure.

Security-first Credibility via Leading Audits

As rug pulls and code exploits plagued smaller-cap DeFi entrants over the last cycle, Mutuum has made technical security a cornerstone. The token scored 90/100 in the CertiK TokenScan audit and launched a $50,000 bug bounty. Just weeks ago, Halborn — a respected cybersecurity firm that has audited Aave, Solana, and MetaMask — completed its report of Mutuum’s v1 lending protocol. It passed with high marks.

This layer of transparency builds the trust needed for institutional partners, while giving everyday investors peace of mind before contract interaction. With both back-end resilience and public accountability in place, MUTM is that rare presale token shipping at production quality.

MUTM’s Asymmetry Sparks Bullish Undercurrents

Among all three cryptos analyzed, MUTM appears uniquely poised to outperform in the early stages of the coming bull cycle. XRP and DOGE may offer stability and community support, but neither combine rapid presale momentum, real protocol utility, and a structured growth path quite like Mutuum. If the asset hits even modest adoption, the current entry price offers asymmetric reward potential unmatched by more mature projects.

As investors brace for an uncertain but opportunistic 2026, the emphasis may need to shift from what’s popular to what’s positioned — and MUTM, with its traction, model, and security posture, fits that emerging narrative.

For more information, visit:

Website:

https://mutuum.com/

Linktree:

https://linktr.ee/mutuumfinance