Current Price Action & Market Sentiment

Right now, Pythia is sitting at $0.04955 USDT, up about +3.34% over the last 24 hours. That’s a decent little pop, showing some buyers are stepping in, but when you zoom out a bit, the picture isn’t quite as rosy. The Relative Strength Index (RSI) is hovering in the mid-40s—basically dead neutral—so we’re not seeing extreme selling or buying pressure at the moment. If you look at the moving averages on the daily and weekly timeframes, the price is still trading below important levels like the 50-period and 200-period EMAs and SMAs, which tells us the broader trend is still leaning bearish. Plus, volatility is pretty high right now based on the Average True Range (ATR), meaning we’re likely to see some big swings during the day, and that comes with added risk.

Recent Developments & Technical Catalysts

There are a couple of interesting things happening with Pythia that could move the needle. First up, Orama Labs is planning to launch a LaunchPad that will tokenize scientific research assets—if that actually happens, it could give the $PYTHIA token some real-world use cases beyond just speculation. Second, Neiry Labs is running their Season 2 accelerator program, which offers grants to neuro-tech projects and airdrops to holders, and that’s definitely keeping speculators interested. But there’s a flip side: regulatory bodies in the U.S. and EU are starting to pay closer attention to biotech and AI-crypto crossovers, which could throw up roadblocks or slow things down. And while the community is pretty bullish and vocal, history shows us that hype alone hasn’t been enough to prevent some pretty painful pullbacks in the past.

Key Technical Indicators & Support/Resistance Matrix

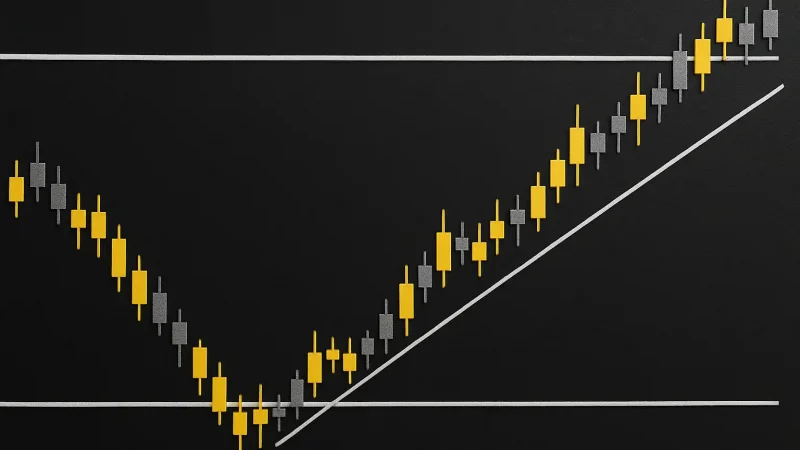

Looking at the charts, the daily oscillators—things like MACD and Stochastic RSI—are mostly neutral or slightly bearish. We haven’t seen any strong crossover signals that would suggest a clear direction yet. There was a bearish engulfing candlestick pattern recently on the daily chart, which is often a warning sign that a pullback might be coming. The Bollinger Bands show the price is comfortably inside the bands without touching the edges, so we’re not in an extreme situation either way—no major squeeze or overextension.

As for support and resistance, here’s what matters: the nearest support levels are around $0.04790, $0.04717, and a stronger floor near $0.04596. On the upside, resistance sits at roughly $0.04984, $0.05105, and $0.05178. If we get a real recovery going, the 78.6% Fibonacci retracement from the last major high (around $0.1259) comes in near $0.05730, which could act as a ceiling. These levels line up with where the 20, 50, and 100-period EMAs are currently acting as resistance above the current price.

Short-Term vs. Long-Term Scenarios

In the next few hours to days, if that support zone around $0.04810–$0.04790 holds up, we could easily see a bounce back toward the $0.05100 area. If buying volume picks up and we break above that, there’s a shot at pushing toward $0.05250—but only if we see some real conviction from buyers and the MACD starts flipping positive. On the other hand, if we lose that $0.04790 level, we’re probably headed down toward $0.04660, maybe even $0.04550. The good news is that volume has been relatively light, so a dramatic crash seems less likely—but it’s still a risk you can’t ignore.

Looking further out—weeks to months—everything really comes down to execution on the fundamentals. If the LaunchPad actually delivers, if we see tangible results from biotech partnerships, and if regulatory concerns get cleared up, then we could gradually work our way back up to test the $0.055–$0.065 zone. But if those catalysts don’t materialize, or if regulatory issues get worse, we might see the downtrend continue toward $0.040 or even $0.035, especially if the broader crypto market rotates back into Bitcoin and away from smaller altcoins like this one.