Recent Catalyst Events Setting the Stage

PIPPIN token has grabbed serious attention lately thanks to a few major developments shaking up both trader sentiment and price action. The token landed a KuCoin listing on January 12, 2026, adding another major exchange to its roster alongside Robinhood and Binance. While this generally means better liquidity, it also tends to crank up volatility—especially for tokens where ownership is concentrated in a few hands. Just a couple days earlier, around January 10, PIPPIN exploded nearly 46% in a single day, mostly fueled by cascading short liquidations. But here’s the catch: that rally was driven more by derivatives market pressure than genuine buying interest or fundamental strength, raising questions about whether it can actually hold. What’s interesting is that whales have been quietly accumulating while retail traders have been heading for the exits, suggesting a behind-the-scenes battle between patient money looking to hold long-term and quick-flip traders hunting their next score.

Current Technical State of PIPPIN

Right now, PIPPIN is hovering around $0.32 USDT—down roughly 4.6% in the last 24 hours from the $0.3103 mark. The technical picture isn’t pretty. When you look at the aggregated signals from major platforms, they’re flashing bright red. For instance, the daily outlook registers as a “Strong Sell,” with nearly every significant moving average from the 5-day all the way out to the 200-day pointing downward. Key oscillators like MACD and Williams %R are either negative or drifting into oversold territory. Bottom line: there’s not much to get excited about from a pure technical standpoint at this level.

Key Support, Resistance, and Risk Levels

If you’re mapping out where the price might find footing or hit walls, here’s what matters. Support is sitting around $0.2920 first, then $0.2404, with a stronger floor near $0.1880—these are levels where buyers have stepped in before. On the flip side, resistance shows up around $0.3960, followed by $0.4485, with that clean $0.5000 level acting as both a psychological magnet and a historical ceiling. If PIPPIN can push through and actually hold above $0.3960, we could see it test that $0.4485 zone. But if it can’t defend $0.29, expect a sharper slide down toward the $0.24–$0.19 range.

Price Projection Scenarios Based on Indicators

Looking at where PIPPIN could head in the near to medium term, there are a few realistic paths depending on how the charts play out.

Bullish Scenario: If PIPPIN manages to climb back above $0.35 and actually stay there—meaning sellers back off and volume picks up—we could see a push toward $0.45. For that to happen, moving averages need to stop falling or start crossing upward (think MA50 crossing above MA100), and MACD needs to flip positive. Getting back to $0.50 isn’t out of the question, but it would probably take something new and exciting—maybe another exchange listing, some institutional money flowing in, or genuinely good news. You’d also want to see volume backing up the move and less crazy leverage activity in the derivatives markets.

Bearish Scenario: Now if PIPPIN breaks below $0.29 without anyone stepping in to buy, momentum could easily carry it down to $0.24, potentially reaching as low as $0.19. RSI might flash oversold, but without any bullish divergence showing up, that’s just another red flag rather than a buy signal. If insiders start dumping or there’s some kind of token unlock flooding the market with new supply, things could get ugly fast.

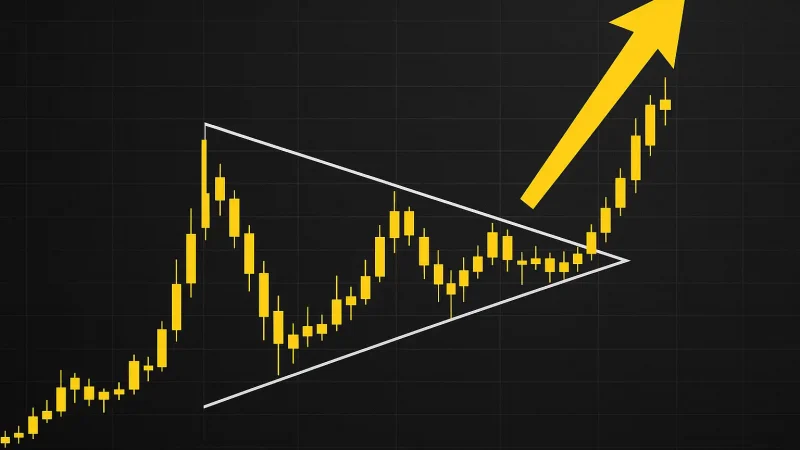

Neutral Case & Technical Conditions to Monitor

The most probable scenario? PIPPIN probably just drifts sideways or slightly down in a range between roughly $0.30 and $0.40 for a while. Watch for signs like the 20-day and 50-day moving averages bunching together, a flattening ADX (which means the trend is losing steam), and Bollinger Bands squeezing tighter (signaling volatility is cooling off). The key breakout triggers to watch are a surge above $0.40 on strong volume, or a breakdown below $0.29. Either one would likely kick the token into a clearer directional move.

Investor Implications & Final Thoughts

Let’s be real—PIPPIN is a high-risk, high-reward play that’s being pushed around mostly by speculation, short squeezes, and a handful of big holders. If you’re thinking about jumping in, you need to be smart about it. Set stop losses near those support levels, keep your leverage in check, and keep a close eye on derivatives data like open interest and funding rates. Sure, there’s upside if things turn around, but the downside risk is very real given the recent drop and weak technicals. For short-term traders working on timeframes under a month, this is more of a tactical game. If you’re thinking longer term, you’ll need real conviction in the project’s roadmap and adoption potential to justify riding out what could be some painful drawdowns.