In a noteworthy shift within the crypto investment landscape,

institutional flows into spot cryptocurrency ETFs have momentarily reversed,

with both Bitcoin and Ethereum funds recording measurable outflows for the first time in over a week.

This unexpected move coincides with a flurry of new ETF filings and procedural delays manifesting from

within the U.S. Securities and Exchange Commission, rekindling debates over market maturity,

regulatory readiness, and investor sentiment in a volatile macroeconomic backdrop.

ETFs See Outflows Amid Broader Uncertainty

After a sustained period of inflows—fueled by market optimism and a rebound in asset prices—

spot ETFs tied to Bitcoin recorded net outflows, with Ethereum following closely behind,

shedding approximately $1.89 million. While the total capital movement remains minor

relative to broader allocations, the shift strikes at a delicate moment when industry participants

expected momentum to build ahead of key regulatory approvals.

Analysts suggest that these redemptions may not reflect long-term bearishness,

but rather short-term portfolio rebalancing, likely in response to the Federal Reserve’s latest

hawkish signals and overall market jitters. Still, the outflows underscore the fragility of nascent ETF markets

in crypto, where investor conviction often hinges on the regulatory environment and signal-driven flows.

Wave of New SEC Filings Signals Expanding Product Landscape

While outflows draw market attention, several fund managers are doubling down on new offerings.

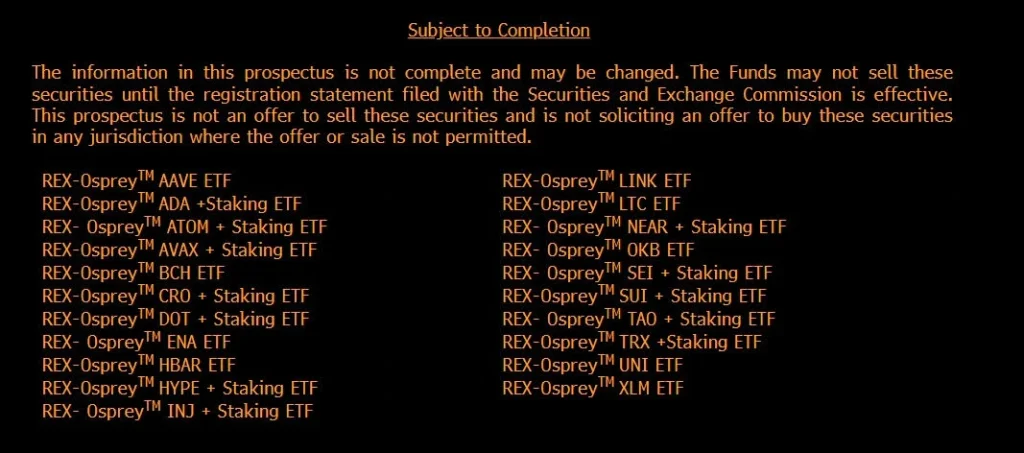

REX Shares, in collaboration with Osprey Funds, submitted an eye-catching 21 separate filings with the SEC on Friday,

representing one of the most ambitious pushes into spot altcoin ETFs to date.

Unlike past filings that focused on flagship assets like Bitcoin or Ethereum,

this suite involves niche altcoins linked to staking yields—SUI, NEAR, CRO, ADA, and TRX prominent among them—

signaling an evolution in product design aimed at yield-hungry institutions.

The coordinated filings mark a strategic effort by REX-Osprey to preempt regulatory acceptance

and position themselves as first movers. These filings build upon earlier applications,

potentially enabling the firm to become a market leader in diversified spot crypto vehicles

once regulatory clarity is achieved.

Defiance Takes a Leveraged Approach

Meanwhile, Defiance ETFs, known for pioneering thematic investing,

has submitted close to 50 ETF filings, many featuring 3x leverage exposure—including crypto assets.

By mixing traditional structure with exposure to highly volatile instruments,

Defiance appears to be appealing to sophisticated traders rather than buy-and-hold institutional allocators.

Notably, its filings include leveraged exposure to Ethereum and Bitcoin,

suggesting conviction in digital assets’ near-term volatility as a market opportunity.

Regulatory Friction Delays ETF Approval Timelines

Just as investment managers ramp up their filings, procedural headwinds have struck.

Ongoing U.S. government shutdowns have delayed the SEC’s evaluation process for ETF applications—

including the Canary Litecoin ETF, which missed its final decision deadline on October 2.

In response, the SEC recently requested fund managers to withdraw certain filings (namely 19b-4 forms),

in a procedural shift meant to facilitate eventual approval via generic listing standards.

According to Bloomberg ETF analyst James Seyffart, this behind-the-scenes maneuvering may actually

indicate that ETF approvals are approaching a breakthrough phase,

even as public timelines stretch and market participants grow impatient.

While the delay frustrates stakeholders, insiders reading between the lines

interpret the requests as an administrative step—rather than a rejection—within a long-anticipated approval pipeline.

Yet, the juxtaposition of regulatory delay with active investor exits presents a challenging paradox:

product innovation is accelerating, but confidence in immediate institutional uptake may be waning,

at least temporarily.

Whether this momentary pullback is a simple breather or a preview of broader investor skepticism

will depend largely on macro conditions, regulatory progress, and the pace at which these new vehicles

make their way into tradable markets.