Recent Developments & Market Sentiment

EGL1 has been making waves in the speculative meme-coin space, riding on patriotic themes and social media buzz. The token runs on the BNB Smart Chain as a BEP-20 contract, and the team has locked liquidity and renounced ownership—moves intended to build trust with holders. That said, there’s no public audit available yet, and the contract includes transfer restrictions that could become problematic if things go sideways with governance or community expectations.

Throughout mid-2025, EGL1 gained serious attention through fresh listings on exchanges like Bitrue, KuCoin, and LBank, plus promotional campaigns such as Bitget’s “Candybomb.” These events drove trading volume surges and pulled in retail traders, but they also brought wild price swings. It’s clear the token leans heavily on hype and listings rather than real-world utility.

Looking at current pricing, there’s a notable gap between what different sources report. While some data shows EGL1 around 0.03895 USDT (suggesting a drop), CoinMarketCap has it closer to 0.0402-0.05185 USDT depending on the exchange and timing—with some markets up about 5% and others down in the past day. This spread highlights how liquidity varies across platforms and the risk of slippage when trading.

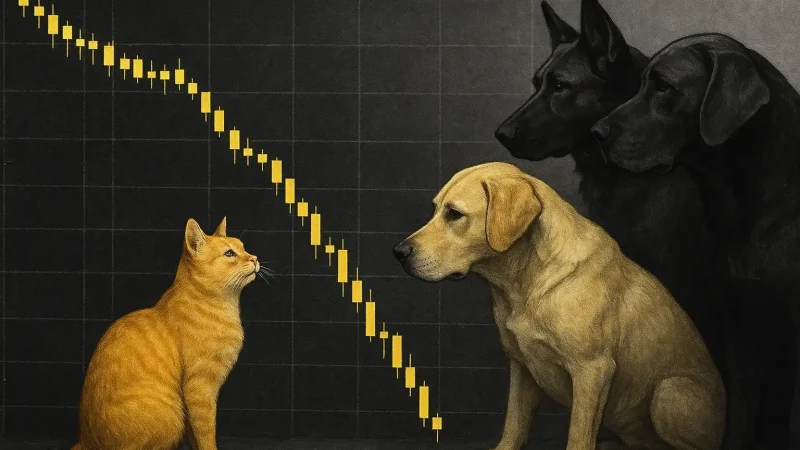

Technical Indicators & Chart-Based Levels

Being a meme coin, EGL1’s price behavior is pretty extreme—think big swings, sudden momentum shifts, and wild overextensions. While detailed hourly or daily chart data isn’t readily available right now, we can piece together that most moving averages (the 50, 100, and 200-period SMAs and EMAs) are sitting above the current price, which points to bearish pressure. Past technical snapshots often show “Strong Sell” signals across multiple indicators like Moving Averages, MACD, Williams %R, and CCI on daily and weekly timeframes.

The Relative Strength Index tends to bounce between extremes—shooting into overbought territory during rallies, then quickly dropping into neutral or oversold zones when the excitement fades. Volatility spikes hard during hype cycles and then settles down during quieter periods.

Key support probably sits somewhere around 0.035–0.040 USDT, where buyers have stepped in before. Resistance looks to be around 0.055–0.065 USDT, levels the token has tested during narrative-driven pumps. If support breaks, we could see a slide toward 0.030 USDT or lower, especially if broader market sentiment sours or Bitcoin starts pulling attention away from altcoins.

Short-Term vs. Medium-Term Outlook

In the short term—think hours to a few weeks—price will probably follow sentiment, community activity, new listing announcements, and volume spikes. A positive trigger like a new exchange listing or influencer endorsement could push EGL1 back up toward 0.055 USDT resistance. But since the price is already below key moving averages and most signals are lagging, any rallies could quickly reverse.

Looking further out over several months, the picture gets trickier. Without real utility development—things like DeFi integrations, revenue models, or a solid roadmap—EGL1 faces growing risk. Some holders might cash out during pumps, community interest could fade, and regulators might start paying more attention to meme tokens. If support around 0.035–0.040 USDT gets tested and fails repeatedly, further drops toward 0.025–0.030 USDT become more likely.

Scenario-Based Price Forecasts & Key Decision Points

Here’s how things might play out under different conditions:

- Bullish Scenario: A major listing or ecosystem incentive reignites speculation. Price breaks through 0.055 USDT resistance and targets 0.070–0.080 USDT. RSI pushes into overbought territory, drawing in latecomers—but this also raises the chance of a sharp drop afterward.

- Neutral Scenario: No big catalysts emerge; market attention shifts to larger altcoins or established meme tokens. EGL1 trades sideways between 0.035 and 0.055 USDT, with a slight downward drift. Support around 0.040 USDT gets tested multiple times; resistance near 0.060 USDT holds firm.

- Bearish Scenario: Low volume, no ecosystem progress, negative macro news. Support at 0.035 USDT breaks, and price slides toward 0.025–0.030 USDT. Confidence drops, order books thin out, and downside moves become brutal. Eventually oversold conditions might trigger a bounce, but expect serious volatility.

Risk Factors & Investor Considerations

Since EGL1 is essentially a community-driven meme asset, the main risks center around narrative fatigue, regulatory crackdowns on meme tokens (particularly in the U.S. and Europe), and liquidity fragmentation across different exchanges.

On the technical side, risks include breaking key support levels, unfavorable comparisons to competing meme coins, and high gas fees or slippage when trading smaller amounts. The absence of a public audit adds smart contract risk to the mix. And let’s be honest—emotional trading dominates this space. FOMO and panic selling drive most of the price action. Anyone looking to trade EGL1 should use strict risk management: set stop losses, limit position sizes, and keep a close eye on social metrics and ecosystem developments.