In recent months, the cryptocurrency market has faced heightened volatility, characterized by significant price drops in marquee assets like Bitcoin and Ethereum. This turbulence has occurred even as traditional assets—gold and the S&P 500—have marked record highs, raising questions about the dynamics at play within the crypto sector. The current market scenario suggests a possible reset phase akin to past market corrections, prompting investors to evaluate their positions critically.

Capital Flowing Out of the Markets

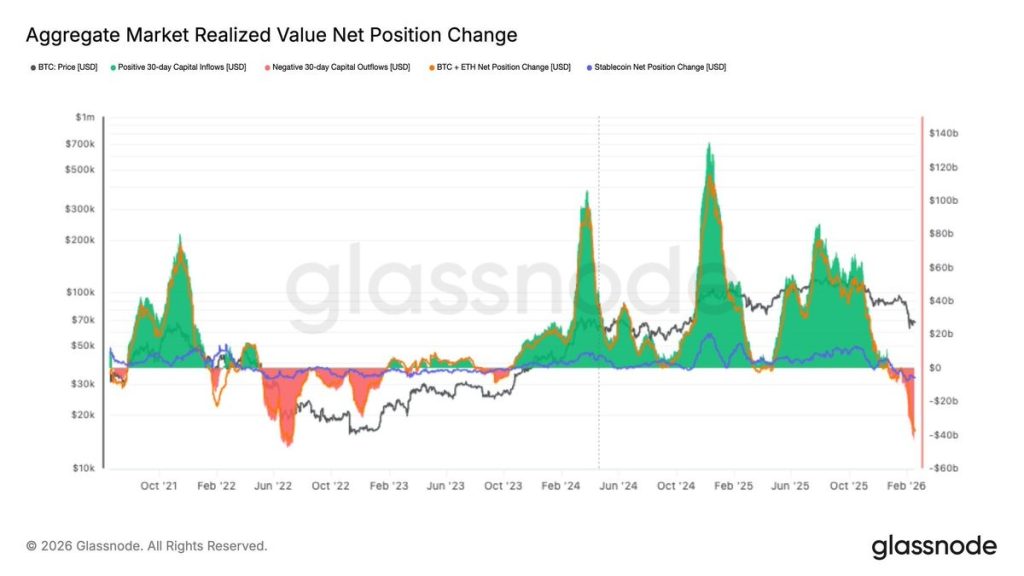

A profound shift is being observed as capital flows out of the crypto markets, fueled by persistent bearish sentiment. Bitcoin, having plummeted nearly 50% from its previous all-time high of over $126K, is at the center of a market-wide reevaluation. Analysts point to Glassnode data that echoes patterns reminiscent of the 2022 market decline. The continuous outflow of capital and the reduced inflow of stablecoins are indicators of a market navigating uncertain waters.

The graph above highlights the sustained outflow, which mirrors the outflows experienced during the 2022 bear market. As Bitcoin’s price declines, the market witnesses rising withdrawals, an indication that investor confidence continues to wane amidst fears of a deeper market correction.

Market Impact and Community Reaction

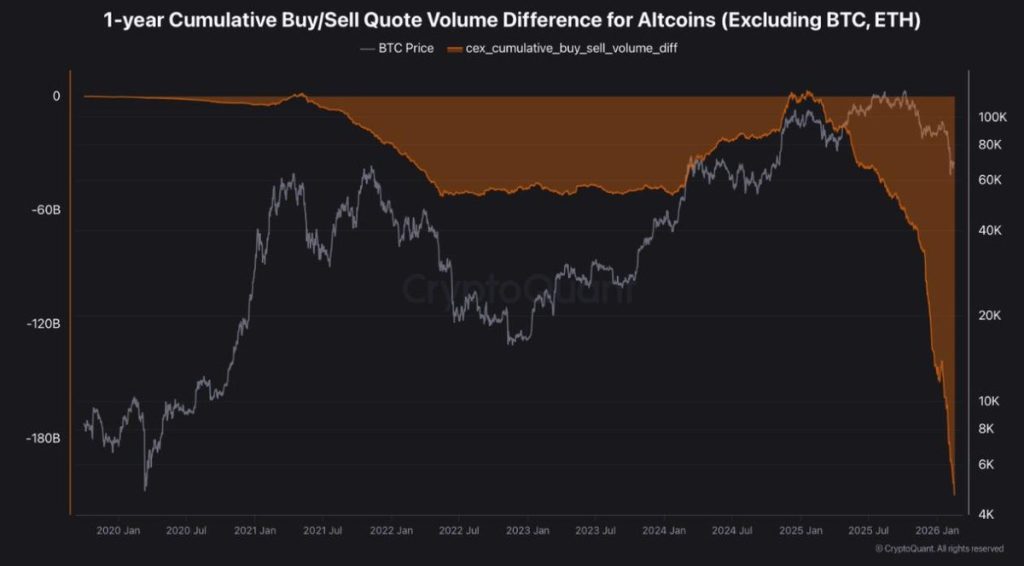

The expanding sell-off pressure has significantly altered market dynamics, particularly in the altcoin space. According to recent metrics, altcoin sell-pressure has intensified, reaching levels not seen in the past five years. This trend has sparked concerns of capitulation, as indicated by the volume difference metrics on centralized exchanges.

Altcoin Sell-Pressure Just Hit a 5-Year Extreme

The above chart illustrates the drastic dip in net buying versus selling pressure, an indicator of heightened liquidity withdrawal and risk-off behavior. Historically, such extreme selling conditions often accompany market bottoms or synchronous late-stage corrections, suggesting the possibility of an impending market reset.

Will the Crypto Markets Undergo a ‘Reset’?

Historical analysis of Bitcoin’s long-term price cycles against the 200-week moving average provides critical insights. This average has consistently acted as a structural support during previous bear phases. The present market situation reveals an approach towards this key support level, suggesting a potential pivot point for the market.

If Bitcoin holds above the 200-week moving average, it may signal the beginning of the next expansion phase. Conversely, a breach below this level could mark the start of a deeper structural shift, effectively resetting the crypto market and possibly initiating a lengthy recovery phase.

The unfolding scenarios underscore the importance of strategic positioning and timing for investors as they navigate potential market adjustments, illustrating the complexities and unpredictability inherent to the crypto domain.