Macro Context & Current Data Snapshot

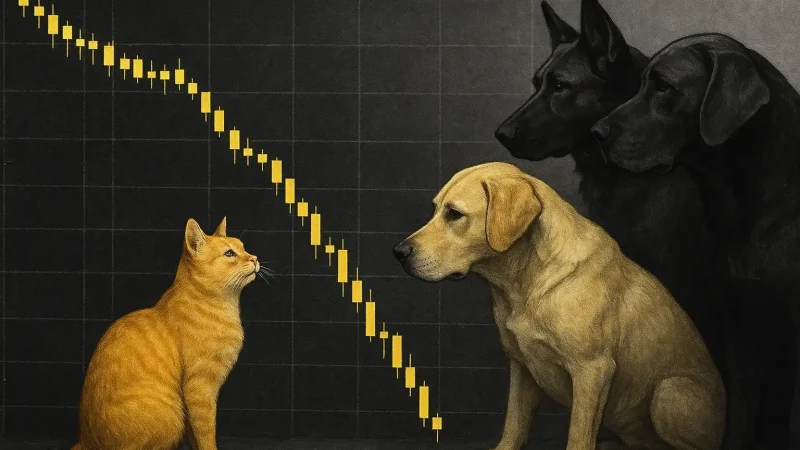

Baby Doge Coin is currently trading around 0.0000000006116 USDT, showing a 24-hour drop of roughly -1.42%, with even steeper losses when you look at the weekly and monthly charts. The token has shed about 20% over the past month, and if you zoom out to a year, we’re looking at losses exceeding 80% from its peak. These numbers paint a pretty clear picture—this token is stuck in a stubborn downtrend. Investor confidence isn’t exactly thriving right now. When you check the moving averages and momentum indicators, they’re leaning bearish, particularly on the longer timeframes. Trading volume has been relatively light too, which means any potential rally might lack the conviction needed to sustain itself in these conditions.

Technical Indicators: Mixed Signals with Leaning Bearish Bias

Momentum, Oscillators & Trend Strength

The Relative Strength Index (RSI) is hovering in the low 40s—not quite oversold, but definitely closer to that end than overbought territory. This suggests there’s still some downward pressure in play. The Stochastic Oscillator is also sitting in the lower ranges without giving us any clear reversal signals just yet. The Average Directional Index (ADX) has climbed into moderate territory, which tells us the current downtrend has some legs, though it’s not overwhelmingly strong. As for the MACD, it’s pretty flat or slightly bearish on shorter timeframes, pointing to weak or neutral momentum at best.

Support, Resistance & Chart Patterns

Right now, BabyDoge is struggling against overhead resistance from descending trendlines that have been in place since earlier highs. The price keeps getting rejected at key moving averages—particularly the 7-day and 30-day simple moving averages—which suggests sellers are defending those zones aggressively. On the flip side, there’s some important support forming around the $0.00000000063–0.00000000067 USDT range. If price breaks below that $0.00000000063 support level, we could see further downside. Looking at chart patterns on the shorter timeframes, there appears to be a descending wedge or corrective structure forming. These patterns can sometimes lead to breakouts, but only if we see volume and momentum come back into the market.

Price Projections: What Levels Matter Near-Term and Mid-Term

Looking ahead over the next couple of weeks, if BabyDoge can hold above $0.00000000063, the first resistance target to watch would be around $0.00000000079. Beyond that, we’re looking at the $0.00000000090–$0.00000000110 USDT zone, where previous supply areas and moving averages tend to cluster. If the price manages to break cleanly above these levels, we could potentially see a move toward roughly $0.00000000150, assuming we get bullish confirmation and the broader meme coin sector cooperates. On the downside, though, losing that $0.00000000063 support would likely send the price tumbling toward $0.00000000050 or possibly even $0.00000000040—especially if overall crypto market sentiment deteriorates or selling pressure picks up.

Key Levels to Watch

• Support critical zone: ~$0.000000000630–$0.000000000670 USDT.

• Resistance cluster: ~$0.00000000079–$0.00000000110 USDT.

• Invalidation level: close below support zone (~$0.00000000063) for bearish risk increasing.

• Breakout confirmation: sustained move above resistance cluster with strong volume, possibly toward $0.00000000150 USDT.

Risk Factors, Catalysts & Outlook

When it comes to potential catalysts, BabyDoge does have some things working in its favor. Its meme-coin status gives it viral potential, and the team regularly implements token burns, plus there are occasional marketing campaigns that can generate buzz. These community-driven efforts can definitely spark short-term price spikes. That said, there are some serious headwinds to consider. The token suffers from low liquidity, derivatives traders are showing negative sentiment, there’s fierce competition from newer, trendier meme coins, and institutional interest is basically nonexistent. From a technical standpoint, while those descending wedge patterns do suggest potential for upside moves, they need real volume and momentum behind them to actually deliver. Without those ingredients, we’re more likely to see false breakouts or sharp reversals that catch traders off guard.