Chainlink as Financial Infrastructure: A Growing Foundation

It’s not an exaggeration to call Chainlink one of crypto’s foundational pillars. With its oracle networks powering real-world data feeds for DeFi, NFTs, and tokenized assets, Chainlink no longer plays the speculative game of hype—it plays the infrastructure role that bridges traditional finance with on-chain systems. Even legacy institutions are beginning to treat it as a keystone, enabling interoperability, automation, and verifiable data.

The analogy has been made: Chainlink today is to decentralized finance what Microsoft was to enterprise computing in the 1990s. When Windows 3.0 emerged, it turned quirky computing into institutional muscle. Similarly, Chainlink is defining standards that banks, asset managers, and fintech giants increasingly rely on to move from off-chain to hybrid or fully-chain-native strategies.

Chainlink is today’s equivalent of Microsoft in 1990.

At that time, personal computers were still primarily the domain of hobbyists and tinkerers rather than the backbone of enterprise operations…

pic.twitter.com/fPzQFjy95y— Rory (@rorypiant)

December 12, 2025

Yet, validation through infrastructure takes time to reflect in price. Although partnerships and network activity continue to grow, LINK remains excluded from many mainstream bullish trends due to fleeting narratives and underappreciation by retail traders.

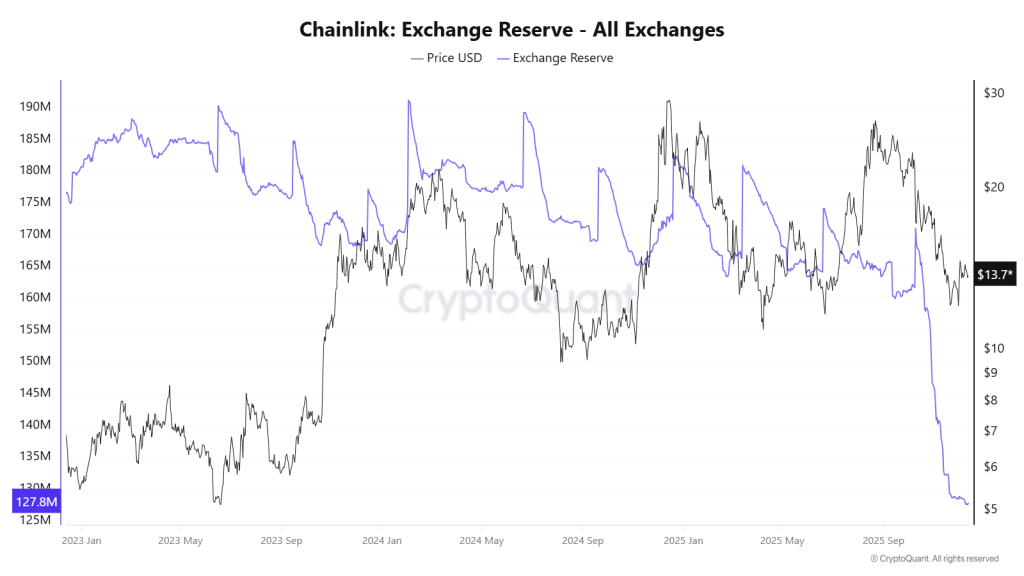

Accumulation Behind the Curtains: Exchange Balances Hit Multi-Year Low

Concrete on-chain evidence reveals a quiet revolution. LINK tokens held on centralized exchanges have fallen from 167 million in October to just under 128 million today. This roughly 25% drop suggests that significant quantities are being withdrawn from liquidity pools. These aren’t traders booking profits—but long-term holders repositioning themselves off-exchange, likely in cold storage or into staking-enabled wallets. The implications are clear: someone is buying, and they’re doing it quietly.

What’s even more telling is the market’s obliviousness to this activity. Unlike the usual pump-followed-by-dump behavior often seen in altcoins, LINK has been bleeding downhill while high-net-worth wallets quietly gather supply. It’s a trapdoor strategy—the lower the price falls, the more valuable the accumulation becomes.

For all the calls of weakness, this bearish price behavior is strategic. By keeping LINK subdued, larger players maintain a stealth discount window. Meanwhile, retail holders capitulate, leaving upside potential heavily skewed toward long-term believers with deeper pockets and longer vision.

ETF Demand Stalls, Undermining Short-Term Momentum

Hope briefly revived when a Chainlink-focused ETF launched in early December 2025. Expectations were high that institutional investors might pour fresh capital into the LINK ecosystem. However, reality has fallen short—net cumulative flows have stagnated around $52.67 million, with weekly inflows often failing to surpass even $10 million. Without consistent capital injection, the ETF has yet to serve as the ignition LINK bulls hoped for.

The ETF’s underperformance underscores a broader hesitation among institutional players to embrace altcoins that lack immediate narratives. Unlike Bitcoin or Ethereum—whose ETFs pulled billions upon listing—LINK’s specialized value proposition may require more education and confidence before it triggers significant Wall Street engagement.

Technically Vulnerable Near-Term, But Structurally Resilient

Technically, LINK’s chart is flashing warning signs. Support around $9 has been decisively broken, and unless new buyers step in, LINK could easily revisit the $8 zone—its next historical demand cluster. The trendline that once supported bullish structures now acts as resistance, trapping momentum below key moving averages.

Support is gone for Chainlink $LINK!

$8 comes into focus.

pic.twitter.com/Fro3XHLFf2— Ali (@alicharts)

December 12, 2025

Yet, here lies the contradiction that makes LINK so fascinating: its long-term fundamental health is improving, evidenced by growing adoption, declining supply, and thought-leadership in Web3 economics. Meanwhile, its market is being suppressed by a lack of speculative enthusiasm and muted institutional conviction.

Building Pressure or Delayed Ascent?

What happens when ETF inflows catch up to on-chain accumulation trends? If institutional understanding matures and LINK reclaims investor attention, the suppressed supply combined with foundational demand could set the stage for a violent repricing. Until then, however, the divergence between Chainlink’s true value and its trading value presents not just a risk—but an opportunity.

In crypto, the loudest coins often rise fastest—but the silent ones build power in the shadows. Chainlink appears firmly in the latter camp for now. Whether its quiet strength eventually erupts into a $60M short squeeze or continues bleeding into deeper accumulation remains to be seen. But for those reading the blockchain’s footprints, the writing is already on-chain.