After a turbulent start to October driven by aggressive profit-taking among major XRP holders, signs are emerging that Ripple’s native asset could be nearing a pivot point. Market data paints a picture of subsiding pressure from large whale accounts and rising quiet accumulation by institutions—a classic setup that has historically preceded breakouts. In the shadows of recent volatility, could crowd selling exhaustion be laying the groundwork for XRP’s next monumental run?

Whale Sell-Off Peaks as Market Declines Steepen

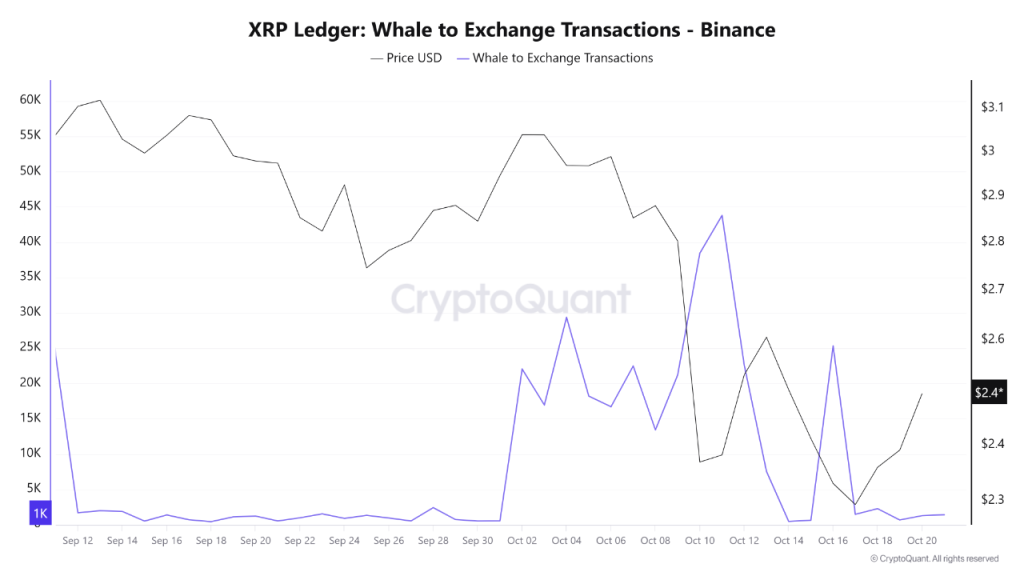

Beginning on October 1, Whale-to-Exchange transactions of XRP began climbing at an alarming rate, peaking on October 11 at over 43,000, according to analytics from CryptoQuant. This marked one of the most intense institutional offloading phases in recent memory. Not surprisingly, the price of XRP slid precipitously during this period—from a modest high above $3 to a sobering low of $2.40 by mid-month. The cascade highlighted whales seizing profit opportunities while adding tremendous downside pressure to the broader market.

Yet, by October 17, large-scale transfers abruptly dried up. Instead of further capitulation, metrics observed a flattening of exchange inflows, hinting that profit-taking might have reached exhaustion. With large holders stepping back, the selling firehose appeared to be closing, setting the stage for stabilization. Since then, XRP has hovered near the $2.20 mark—a plateau forged not through hype, but seemingly through organic equilibrium between seller fatigue and emerging demand.

Institutional Accumulation Suggests Quiet Confidence

While retail traders continue to offload XRP amid shaken sentiment, blockchain analytics platform Santiment reports a sharp uptick in loss-driven transactions—hallmark behavior of panic-driven exits. Historically, this environment often creates prime conditions for accumulation by more sophisticated market entities.

Recent activity validates the idea: institutional wallets have been absorbing a significant portion of this crowd-generated supply. This shift is crucial, as meaningful reversals in crypto markets are rarely sparked by retail enthusiasm. Instead, they often rise when market-smart buyers quietly enter against a backdrop of fear and disbelief. XRP’s brief dip below $1.90 on October 18, followed by a rebound past $2.40 within days, exemplifies the volatility that arises when panic intersects with strategic accumulation.

Symmetrical Triangle Forms as XRP Eyes Technical Break

Despite the noise, XRP’s technical setup is coiling into a potentially explosive formation. Price action over the past several months is exhibiting a textbook symmetrical triangle pattern, with higher lows from June and declining highs from July forming convergent boundaries. This consolidation phase—stretching from $1.90 support up to a resistance line near $3.66—indicates a market unsure of its direction, yet brimming with latent energy.

If XRP can close decisively above the descending resistance—particularly with a catalyst like favorable macroeconomic news or a high-profile institutional buy-in—the path toward retesting $3.66 becomes tangible. Beyond that level lies uncharted yet psychologically meaningful territory toward $5. While technical patterns offer probabilities, not guarantees, the convergence of structure and sentiment tilts the odds increasingly towards a bullish breakout in the approaching months.

Shift in Sentiment Could Spark a Crowd-Defying Reversal

The psychology of markets often favors those who act in discomfort. Currently, retail fear is palpable, yet that very climate has historically laid the foundation for strong reversals. As crowd selling decelerates and XRP stabilizes above key support, institutional positioning continues to shape a quieter but sturdier upside.

If recent patterns hold, we may be witnessing not just a lull in price turmoil, but a subtle regime change— one where smart money puts in LONG positions against the fading echo of early-October’s panic. Should momentum persist and whales stay sidelined, XRP may be preparing its next sprint—not away from the past, but straight into it: eyeing new highs with renewed focus.