Recent Rally Context & Fundamental Drivers

Since early December 2025, WHITEWHALE has gone from being virtually unknown to becoming one of the hottest memecoins in the Solana ecosystem. The turning point came on December 7, when the influencer behind the project, @TheWhiteWhaIeV2, took control of the treasury and made a bold promise: all creator revenue would go straight to the community, and he locked up his own tokens until 2063. This gesture rebuilt trust among investors and pushed the market cap above $50 million. The token’s price went absolutely wild, surging nearly 500 times over the course of about 30 days.

The numbers tell a story of wild volatility and intense trading. Daily volume has regularly climbed into the tens of millions of dollars, while the community has been running giveaways and amplifying the token across social media—all of which has fueled both on-chain buying and the overall narrative. Starting from its launch on Pump.fun back in October 2025, WHITEWHALE’s journey to those explosive December prices has been driven as much by hype and community psychology as by any real technical fundamentals or utility.

Technical Analysis & Price Prediction

Current State & Risks of Over-extension

As of early January 2026, WHITEWHALE is hovering between roughly $0.08 and $0.086 USDT, having just hit an all-time high around $0.08614. Looking at the technicals, it’s pretty clear this token is running hot. The Relative Strength Index (RSI) has shot past 95 during recent breakouts, which is a classic sign of being overbought. Meanwhile, we’re seeing a golden cross—where the 20-day exponential moving average crosses above the 50-day—suggesting some medium-term upward momentum.

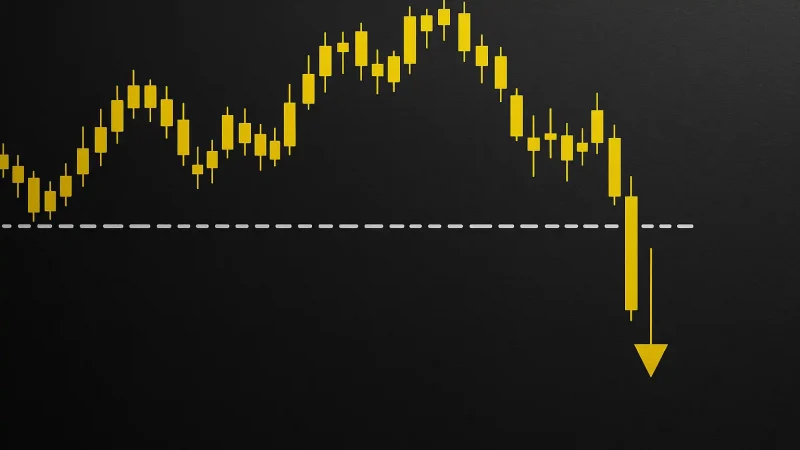

But here’s the catch: when RSI levels get this extreme, they usually signal that a pullback is coming. Historically, tokens with RSI above 95 tend to drop anywhere from 25% to 40% once buying pressure starts to fade. Right now, the key support level to watch is around $0.048, which represents the 23.6% Fibonacci retracement of the recent move. If that level breaks, things could get ugly fast.

Upside Targets & Scenario Analysis

If WHITEWHALE can keep the momentum going—fueled by its strong community narrative, continued speculative inflows, and sustained social media buzz—we could see it push toward $0.096 per token. That would represent roughly a 20-25% gain from current levels and would take it beyond recent resistance zones.

In a really bullish scenario, breaking above $0.096 could open the door to even bigger gains, potentially toward $0.12 or even $0.15. But that would require exceptional volatility, strong sustained demand, and some help from things like token burns to manage supply. Without those factors, any gains at those levels would probably be short-lived. It’s also worth noting that this kind of move would depend heavily on broader memecoin sentiment in the Solana ecosystem staying positive.

Bearish Scenarios & Key Triggers for Correction

On the flip side, there are some serious risks here. If buying momentum starts to dry up—say, if 24-hour volume drops significantly—or if the broader crypto market shifts into risk-off mode with money flowing back to established coins, WHITEWHALE could see some brutal pullbacks. A break below that $0.048 support level would likely trigger a sharp decline, potentially sending the price down to the $0.025-$0.035 range, which aligns with deeper Fibonacci retracement levels (38.2% to 61.8%) from the recent rally.

Watch the MACD indicator too. When you see divergences—where price is making new highs but the MACD histogram is actually shrinking—that’s often an early warning that the trend is about to reverse. Given how overextended this token is right now, traders should be on high alert for these kinds of signals.