Recent Developments & Market Context

Non-Playable Coin (NPC/USDT) is currently hovering around $0.01237, down roughly 4.90% over the last 24 hours. The token has been stuck in a downtrend lately, and most short-term predictions aren’t looking too optimistic—though longer-term outlooks show a bit more hope. Some forecasters think NPC could slide down to about $0.00921 by early February 2026, which would be nearly a 25% drop from where it’s sitting today. It’s already fallen more than 20% over the past month alone.

On the development side, the NPC team has been working on things like Launchly, which is basically an AI-powered launchpad that lets creators turn their media content into tokens. One interesting point is that they’re not planning to issue any new tokens beyond NPC itself, which suggests they’re focused on actual utility instead of just pumping out more supply. That said, there’s been some chatter in the community—not all of it positive. Some people have raised questions about the project’s legitimacy on Solana and whether all the marketing claims hold up. Nothing official has come out in terms of regulatory issues, but trust and transparency are definitely things people are keeping an eye on.

Key Technical Indicators and Their Implications

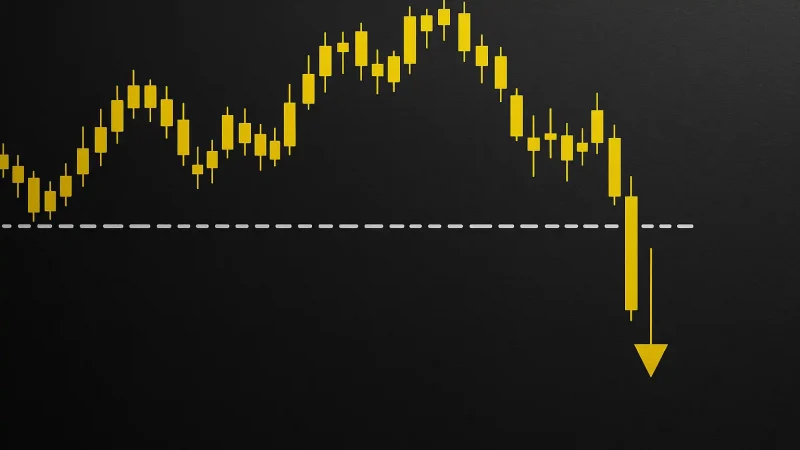

Looking at the daily charts, NPC is flashing a pretty clear “Strong Sell” signal based on moving averages and other technical indicators. The simple moving averages across 5, 10, 20, and 50-day periods are all leaning bearish. Momentum indicators aren’t helping either—the RSI is sitting around 42, and the MACD is negative, which basically means the bears are in control right now.

Other indicators paint a similar picture. The Williams %R is showing oversold conditions, the ADX suggests the current trend isn’t particularly strong, and the high/low bands are supporting the downward movement. One thing worth noting is that volatility (measured by ATR) is pretty low at the moment, meaning we probably won’t see any dramatic price swings unless something significant happens to shake things up.

As for price levels to watch, resistance is likely hanging around the recent highs near $0.015-$0.016 that we saw back in late November. Support zones are looking to be around $0.0092-$0.0100 based on one-month projections. If that $0.0092 support level breaks, we could see things slide even further down toward the $0.0085 area.

Price Forecast Across Timeframes

Short Term (Next 1-4 Weeks)

Based on how the charts look right now and the recent momentum, NPC will probably keep trending downward in the near term. A drop toward $0.0092 seems pretty realistic, and there’s a chance things could get worse if trading volume stays weak. We might see some temporary bounces here and there, but unless the moving averages get broken, resistance in the $0.0130-$0.0140 range will probably hold firm.

Mid Term (3-6 Months)

Over the next few months, the outlook stays somewhere between bearish and neutral unless we see some solid fundamental developments or the broader crypto market starts recovering. A reasonable guess would put NPC trading somewhere between $0.0085 and $0.0150, with the lower end being more likely if overall market sentiment stays negative. That said, if the NPC team actually delivers on things like Launchly and it gains real traction, we could see a move back above $0.0200.

Long Term (By End of 2026 and Beyond)

Looking out to 2026, most forecasts put NPC somewhere in the **$0.0200 to $0.0300** range if things go well, though more conservative estimates lean toward **$0.0150-$0.0200**. Some longer-term models are predicting an average around $0.026 for 2026 under moderately optimistic conditions.

If we’re talking really long-term—like 2028-2030—and assuming the team keeps building, the tokenomics stay solid, and the overall market conditions are favorable, projections stretch into the **$0.030 to $0.08 range**. Getting above $0.10 seems pretty speculative at this point and would require some major shifts in adoption and use cases.