As 2025 approaches the final stretch, investor sentiment is shifting. After a relatively quiet year for altcoins, analysts and traders alike find themselves examining key signals across a variety of digital assets. One project generating particular buzz is SUI, an emerging Layer 1 blockchain that has already dazzled the market once with a staggering rally. Now, its technical chart structure and underlying fundamentals suggest history could repeat itself — if not exceed expectations.

SUI’s Technical Setup: Post-Euphoria Calm Hints at Impending Volatility

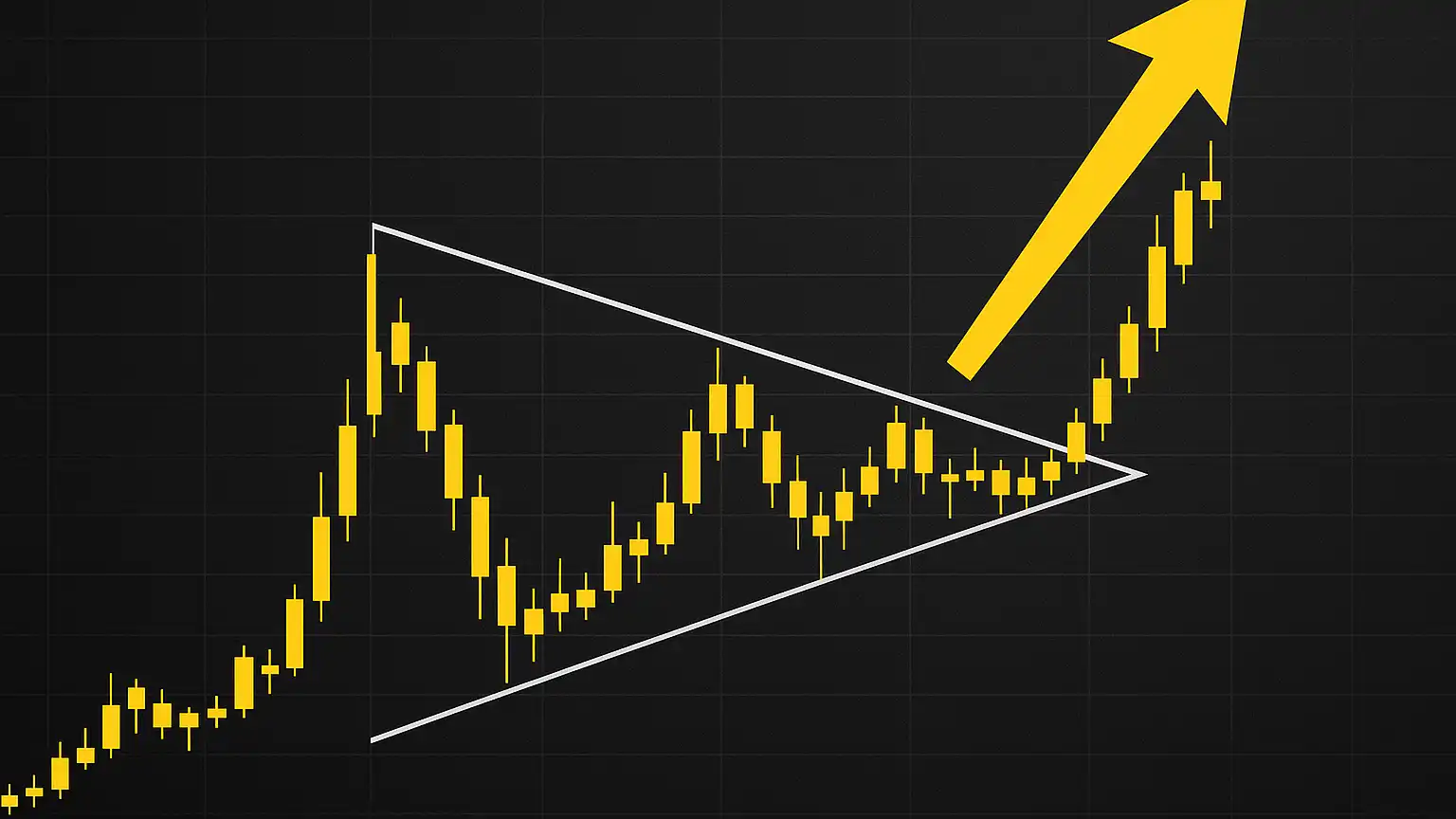

After exploding over 950% in the latter half of 2024 — rising from just $0.49 to an all-time high of $5.32 — SUI entered a well-defined consolidation phase. The coin currently trades within a broad symmetrical triangle, a pattern often associated with measured continuation or reversal moves. Structurally, this indicates indecision in the market, but also potential. The narrowing range, fueled by sustained interest rather than speculation, mirrors accumulation phases seen in previous crypto cycles — including those preceding historic rallies in coins like Solana and Avalanche.

Market breadth within SUI’s symmetrical triangle has gradually shrunk, bringing attention to the $2 support level. Holding above it keeps bullish narratives intact, while a breakdown could challenge the asset’s resilience. But as with many cryptos, price alone doesn’t tell the full story — especially not with SUI.

On-Chain Fundamentals Tell a More Optimistic Story

While the SUI price cools, the blockchain ecosystem powering it is anything but quiet. According to Suiscan analytics, the network recently surpassed 225 million total accounts — a remarkable feat, placing it alongside the most active blockchain platforms in the industry. Even more revealing was the spike on October 28th: nearly 924,000 new wallets were created in a single day. This is not idle speculation; this is real user momentum.

Beyond user activity, the financial gravity of the SUI ecosystem remains undeniable. Though its Total Value Locked (TVL) has pulled back from its peak, it still hovers around $1.89 billion — a level that would’ve ranked among the top protocols just a year prior. That persistence during price consolidation suggests institutional and long-term community confidence, echoing early phases of Ethereum’s DeFi growth or the Avalanche Rush era in 2021.

Stablecoin Inflows Signal Sticky Capital and Expanding Use Cases

Another clear vote of confidence comes from the sharp rise in stablecoin supply flowing through the SUI ecosystem. The network’s stablecoin market cap has nearly doubled in recent weeks, climbing from $560 million to over $1.15 billion. For DeFi-native assets like SUI, this trend cannot be overlooked. Stablecoin inflows typically precede risk-on behavior as users allocate funds across DEXs, lending protocols, and yield farms — all of which rely on SUI’s infrastructure.

Moreover, the rise of stable-backed activity points to maturing utility. It’s no longer just speculation driving transactions—it’s actual financial activity. Liquidity providers, DAOs, and institutional traders are deploying serious capital. These on-chain behaviors serve as the heartbeat of any thriving Layer 1 ecosystem, and for SUI, it beats stronger every month.

Will 2025 See a Breakout Worthy of Its 950% Past?

With a tightening technical pattern, explosive past price behavior, surging ecosystem growth, and ballooning stablecoin liquidity, SUI is entering a critical moment. If bullish momentum re-emerges — possibly catalyzed by macro tailwinds or on-chain events like token burns or partnership announcements — the breakout from this symmetrical triangle could be swift and aggressive. Traders eyeing a move back toward $5.32 are not deluding themselves; that move lies within historical precedent.

If the triangle holds without a breakout through Q4 2025, the chart may reset expectations to early 2026. Such a delay is far from bearish; instead, it could catalyze longer-term setups for institutions eyeing entry points below ATH. Either way, SUI’s current positioning — both technically and fundamentally — elevates it from a standard altcoin to a legitimate case study in Layer 1 relevance during crypto’s maturation cycle.

Conclusion: SUI Stands Ready for Whatever Comes Next

In a market where narratives shift daily and hype often supersedes substance, SUI’s consolidation feels strangely mature. Backed by rising user adoption, sticky liquidity, and a strategic technical pattern, it offers one of the more balanced setups among major crypto assets heading into 2025. For traders, it’s a coin to return to regularly. For developers and investors, it’s a network that may quietly ascend into the top-tier blockchain conversation — with or without a 900% rally.