In the fast-paced world of cryptocurrency, rebounds are often mistaken for recoveries—but the recent bounce in Solana’s (SOL) price might not be as bullish as it looks on the surface. Following a brutal liquidation-driven sell-off that wiped over $350 billion from the total crypto market cap, SOL tumbled to $67.31—levels unseen since December 2023. While Bitcoin managed to reclaim $67,000, Solana’s rebound above $83 has sparked new debates: is this the beginning of a true recovery, or merely a short-lived respite in a broader downtrend?

Trading Bounces, but Trust Doesn’t

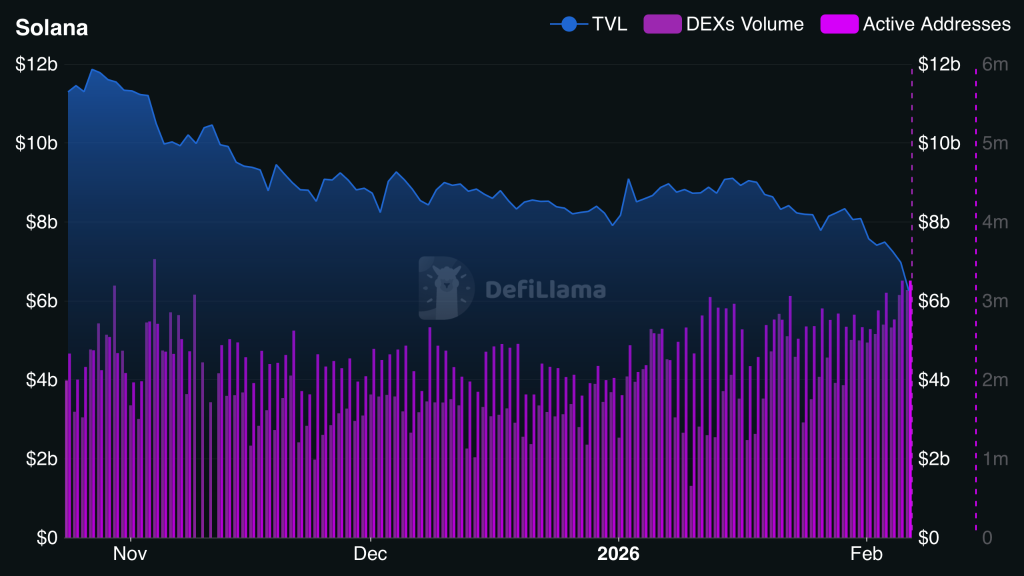

The crypto market saw a sharp uptick in short-term trading as prices recovered from the crash. While active wallet addresses and decentralized exchange (DEX) volumes on the Solana network have surged in recent days, they may be signaling momentum more than meaningful conviction. The activity suggests renewed engagement but lacks confirmation from long-horizon investors. Those who typically anchor a bullish trend—liquidity providers, protocol stakers, institutional allocators—have largely remained on the sidelines.

Technical indicators offer a shaky picture. Momentum oscillators hint at oversold conditions, but broader market structure continues to flash uncertainty. Most notably, Total Value Locked (TVL) on the Solana blockchain has continued to trend downward—an indication that capital is being pulled from decentralized applications despite the uptick in asset price. It’s a divergence that tempers any enthusiasm about a sustainable rally.

Source: Defilama

Market Betting on Both Outcomes—Hedging or Hoping?

A deeper look into derivatives markets reveals a market hedged for volatility more than committed to any upside. Open interest in Solana futures has climbed—an indication that traders are reopening positions—but the context matters: funding rates remain negative. That means more participants are betting against the rally than for it. Rather than reflecting optimism, the increased activity could point to traders expecting to fade strength.

A Squeeze without a Signal

Over the past few weeks, SOL has fallen more than 21% from highs above $106 before recovering about 18% from its recent bottom. While that might suggest resilience on the surface, the positioning data tells another story. The increase in activity doesn’t signal confidence—it reflects a market grasping for confirmation. And confirmation hasn’t arrived.

Funding remaining negative at this stage of the bounce is especially telling. It suggests that traders believe the rally may falter and are willing to pay a premium to hold short positions. This behavior is common in relief rallies—where price rises are more about short covering and rotation than fresh bullish capital entering the market. Until TVL stabilizes and fundamentals regain strength, price alone can’t convince seasoned investors to reenter.

Price at a Crossroads: $100 or a Slip Back to $60?

Technically, Solana is now navigating a narrow inflection zone. The $80–$82 area serves as immediate support, with resistance looming near $93–$95. A weekly close above that range could affirm a bullish trend continuation, possibly targeting $100. But failure to hold support threatens a cascade back to $70—and under heightened volatility, even to $60 or lower.

The broader crypto market’s direction will also weigh heavily. While Bitcoin’s resilience has often benefited Solana due to its high-beta behavior, it’s clear SOL is experiencing deeper fluctuations. That sensitivity could either accelerate gains in a bullish environment or amplify losses if sentiment sours again. February’s close may be pivotal—not just in shaping SOL’s path—but in setting the tone for mid-year investor interest across the broader Layer-1 space.