Current Landscape & Market Signals

Mog Coin (MOG/USDT) is currently changing hands around $0.000000224, down roughly 7.4% over the last day. That’s a pretty steep drop from the recent peak near $0.00000030, showing just how quickly sentiment can shift in this corner of the market. With a market cap hovering between $95 and $100 million and about 390.6 trillion tokens floating around, MOG is squarely in meme coin territory. Daily volume sits at a modest $7–10 million, but the energy seems to be draining as traders pivot back toward Bitcoin and the safer, bigger names.

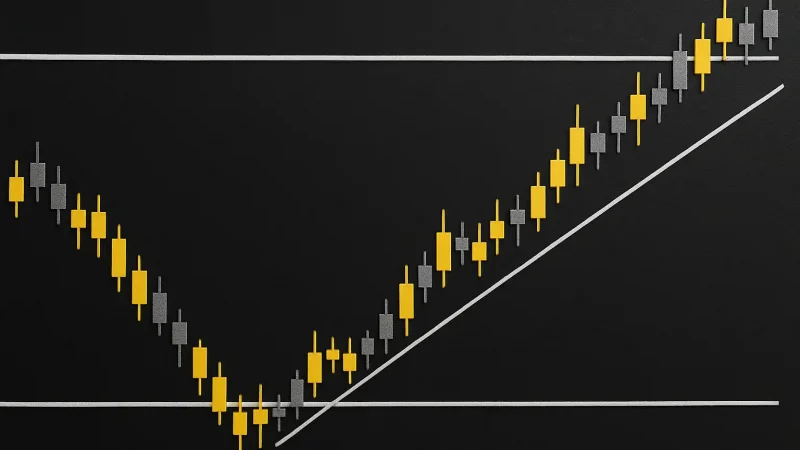

From a technical standpoint, things look a bit shaky. The 14-day RSI is sitting in the low 30s—approaching oversold levels, but not quite screaming “buy” just yet. The 5-day, 20-day, and 50-day moving averages are all overhead, acting as a ceiling on any bounce attempts. The MACD is pretty much flat with a slight bearish tilt, the ADX is showing that the downtrend has some muscle behind it, and Williams %R is deep in oversold territory. In short, the indicators are painting a cautious picture.

Key Zones & Predictive Scenarios

The key support zone to watch is somewhere between $0.00000020 and $0.00000022. If that doesn’t hold and sellers really turn up the heat, we could see MOG slide down toward $0.00000015 or even lower—territory it hasn’t visited in a while. On the flip side, resistance is stacked up around $0.00000027 to $0.00000030. Those levels line up with previous local tops and those pesky moving averages. To crack through $0.00000030 in any meaningful way, MOG would need a serious volume spike and probably some kind of good news—whether that’s regulatory clarity, a viral moment, or just renewed hype from the community.

Bearish Scenario

If MOG can’t hold above that $0.00000022 floor, things could get ugly fast. With RSI already flirting with oversold and the trend indicators confirming downside momentum, we might see a retest of those early-March and late-February lows around $0.00000015 to $0.00000018. In this scenario, it’s likely that profit-takers will keep selling into any strength, especially if Bitcoin stays strong and continues pulling capital away from speculative plays. Sure, oversold readings might spark a few quick bounces, but without real volume backing them up, those rallies probably won’t have legs.

Bullish Scenario

For the bulls to take back control, MOG needs to punch through that $0.00000030 resistance and actually hold above it—not just spike and fade. If that happens with solid volume, the next targets come into view: $0.00000035 to $0.00000040, and maybe even a run at $0.00000050 if things really get cooking. Of course, there are still plenty of obstacles—long-term moving averages, likely sell walls, and general market skepticism. Bullish catalysts could include fresh momentum around crypto ETFs, some viral social media buzz, or a broader rotation back into altcoins. Until we see those factors align, though, any upside will probably be choppy and limited.

Final Insight: Risk Stack & Trading Implications

Let’s be real—MOG Coin is a high-risk play. With over 390 trillion tokens in circulation and potentially concentrated wallet holdings, there’s always the risk of a sudden dump that catches people off guard. The broader market isn’t helping either: Bitcoin dominance is rising, fear and greed indicators are leaning toward fear, and regulatory clouds still hang overhead. That said, MOG is getting close to oversold levels, which might tempt some aggressive traders looking for a speculative bounce. If you’re thinking about taking a shot, consider entries near $0.00000020 to $0.00000022 with tight stop-losses below $0.00000018, and keep your eyes glued to that $0.00000030 resistance zone. This isn’t a trade for the faint of heart.