For traders and long-term investors alike, Bitcoin’s recent correction beneath the $89,000 mark is triggering déjà vu—only this time, the signs point to a complex and evolving market structure that feels less like a bubble popping and more like a system adapting. With the price hovering at levels that analysts once deemed unshakable, traders face a familiar foe: extreme fear.

What makes 2026 different, however, is that this isn’t a fallout from a major hack, exchange scandal, or regulatory landmine. There’s no obvious smoking gun or Lehman-style bankruptcy driving the collapse. This time, the pressure seems to be internal—systemic restructuring of how Bitcoin is bought, sold, and held.

Fear Returns—But the Market Has Changed

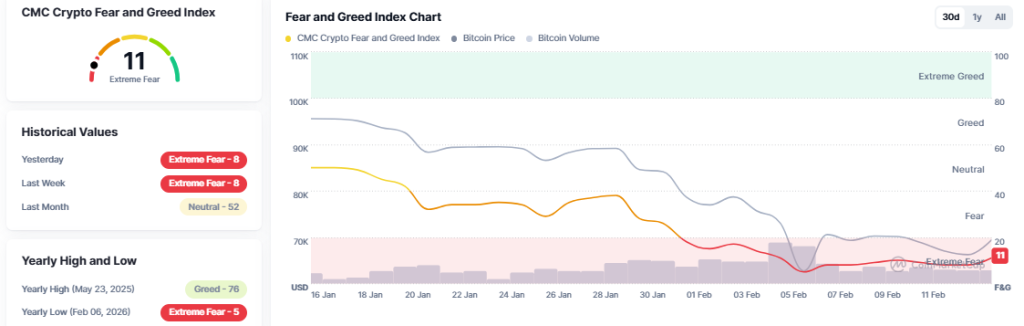

Earlier this year, Bitcoin briefly spiked to new all-time highs before sentiment turned sharply, undoing weeks of gains. The February low of $60,001.01 printed amid what analysts labeled an “Extreme Fear” sentiment zone—mirroring preceding cycle bottoms like the COVID crash ($3.8K), Mt. Gox capitulation ($421), or the post-FTX washout ($15.6K). But interpreting this dip as a bottom ignores the very different players in today’s arena.

During past crises, retail panic was the primary engine behind volatility. Government policy barely acknowledged crypto, and institutional players kept their distance. Today, the dynamic has flipped. We are now seeing a coordinated, if somewhat opaque, reallocation of capital from major institutions via ETF mechanisms, custodial cold wallets, and algorithmic execution engines. Fear persists, but the actors behind it are considerably more sophisticated.

ETFs, Liquidity Tide Shifts, and Sentiment Disconnects

With the advent of spot Bitcoin ETFs, traditional market forces exert more gravitational pull on the cryptocurrency ecosystem. Prices are no longer shaped exclusively by social media buzz or Reddit-fueled buying sprees; they now hinge on flows from billion-dollar pension funds and hedge fund rotations aligned with macro liquidity strategies. This risks making sentiment tools like the Fear & Greed Index less predictive—a relic in a data-rich algorithmic battlefield.

Consequently, what looks like “fear” from a retail perspective may simply be structured profit-taking or deleveraging from asset managers. ETF rebalancing windows, central bank rate signaling, and options gamma squeezes contribute to volatility patterns not seen in crypto just five years ago. In this framework, a sub-$60K Bitcoin may not mark irrational panic, but rather intentional recalibration.

Whales Stir Amid Fragile Sentiment

Adding more uncertainty to the equation is a flurry of whale movement. Just days ago, an address attributed to Garrett Jin—a long-known early Bitcoin holder with a history of well-timed trades—transferred 5,000 BTC (approx. $348.82 million) to Binance. Large inflows to centralized exchanges are often interpreted as potential sell-offs, injecting additional apprehension into an already jittery market.

Bitcoin just reclaimed $70,000 — but Garrett Jin (#BitcoinOG1011short) is selling again!

He just deposited another 5,000 $BTC ($348.82M) into #Binance.

https://t.co/LyveMqUKoj

pic.twitter.com/wQbfKtdueb— Lookonchain (@lookonchain)

February 14, 2026

These whale-triggered liquidity events can front-run sentiment shifts and lead to unexpected downward pressure—even as indicators suggest markets should be recovering. In practice, retail behavior is often just reacting to a tidal change already underway.

Looking Beyond Fear: Durable Bottom or Dead Cat Bounce?

Price history suggests that sentiment zones labeled “Extreme Fear” often precede significant rallies. But past is not always prologue. Without easing macro pressures, observable net inflows, and ETF demand leading rather than lagging action, the current level may not represent a true bottom, but an in-between.

Long-term accumulation may still occur here—but timing it is no longer about buying the crash; it’s about reading systemic signals in an environment where emotion plays second fiddle to liquidity structures. Traders expecting a V-shaped reversal might be waiting longer than expected. On-chain data, whale activity, and TradFi positioning offer clearer clues than a sentiment gauge frozen on red.

What remains clear is this: Bitcoin has entered a new era—one where the catalysts, corrections, and comebacks are no longer driven by psychology alone. The next leg up, when it comes, won’t just need courage. It’ll demand conviction informed by inter-market awareness.