Recent Developments & Market Context

The memecoin community has been buzzing lately about MEW (Cat in a Dogs World), a cat-themed token built on Solana that’s caught the attention of speculative traders. During its peak run, it managed to briefly break into the exclusive billion-dollar market cap club, standing shoulder-to-shoulder with other feline favorites like Popcat and Bonk during the cat-coin craze that took off in late 2024. MEW’s all-time high hit somewhere between $0.011 and $0.0129 before things cooled off. Right now, there are roughly 88.88 billion MEW tokens in circulation, with the market cap sitting in the tens of millions.

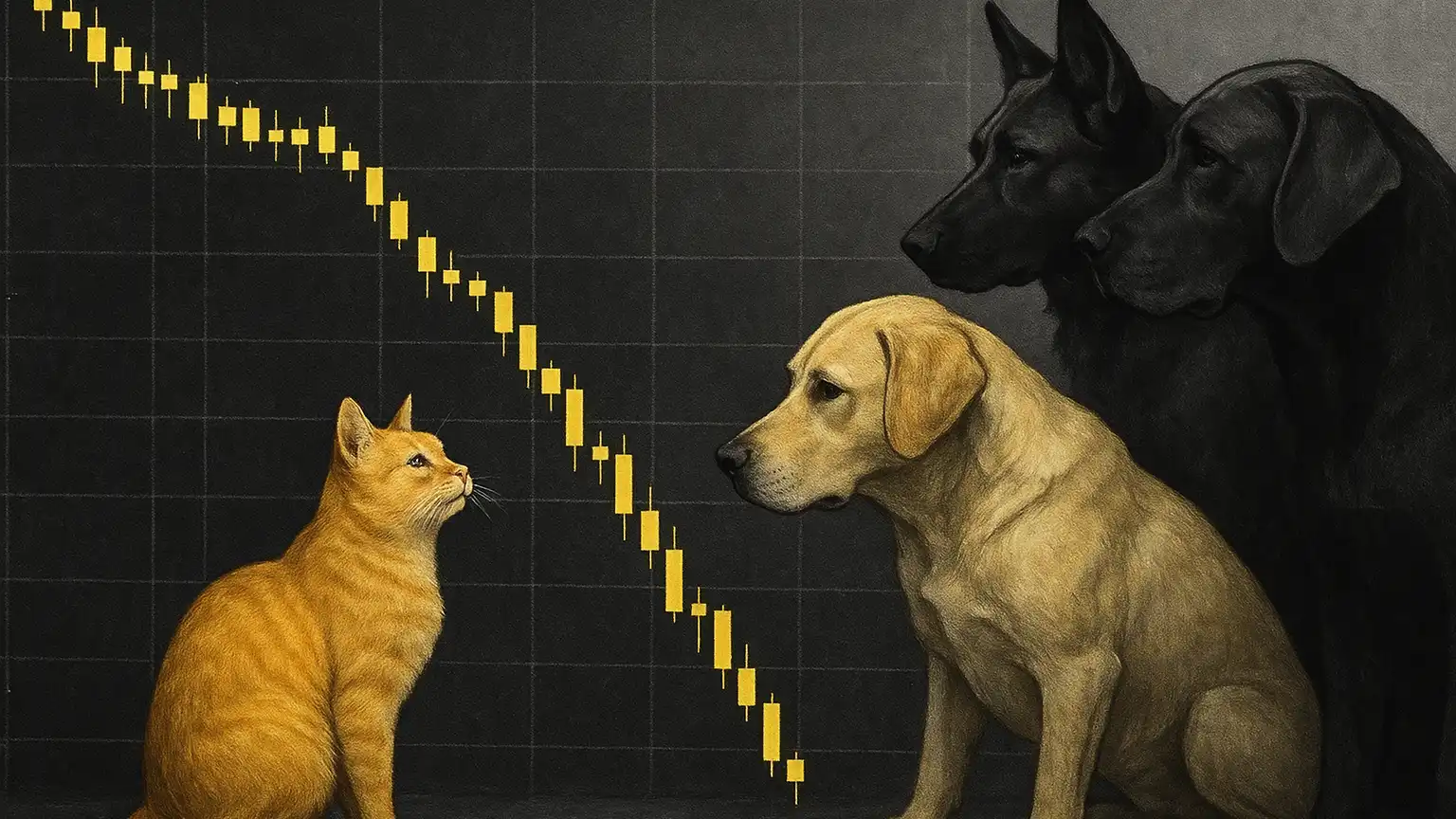

Fast forward to today, and MEW is trading way below those glory days. The broader memecoin sector has taken a beating, with crypto investors pulling back on riskier bets across the board. Most technical platforms are flashing “strong sell” signals for MEW, with moving averages pointing firmly downward.

Technical Indicators & Price Structure

At its current price of $0.0005735 USDT, MEW has fallen dramatically from its peak. The token is now trading well below its major simple and exponential moving averages—the 7-day and 30-day SMAs that once provided support now act as resistance. However, there’s an interesting twist: multiple indicators are screaming “oversold.” Here’s what the technicals are telling us:

- The RSI-14 is sitting pretty low, which typically suggests we might see a relief bounce rather than continued downward momentum.

- MACD histograms are still in negative territory, showing bearish momentum is still in control. That said, the slope is flattening out a bit, which could mean the selling pressure is starting to ease up.

- The ADX (Average Directional Index) is elevated, confirming that there’s still a strong trend in place—unfortunately for bulls, that trend is still pointing down.

- Critical support levels are hanging around **$0.000504–$0.000520**, which marks MEW’s recent swing low. Meanwhile, resistance zones are clustered around **$0.000707–$0.000820**, right where those former moving averages are sitting.

Trading volume has dried up over the past several days, showing that traders have lost interest for now. Without fresh catalysts to spark interest, this low volume environment makes genuine breakouts unlikely and actually increases the risk of further drops.

Fibonacci & Moving Average Zones

Looking at Fibonacci retracement levels from MEW’s all-time high, the 23.6% level around $0.0010–$0.00105 is acting as a stubborn ceiling right now. If MEW can somehow punch through that zone, it could open the door to higher targets like the 38.2% retracement around $0.0018. But honestly, without strong volume backing it up and clear bullish confirmation, that scenario remains pretty optimistic.

Forecast Scenarios

Base Case: Continuation of Downtrend with Relief Bounces

As long as MEW stays stuck below that $0.00070–$0.00082 resistance zone, the path of least resistance is probably down toward the recent low around $0.00050. Sure, we might see some relief rallies when things get too oversold, but without serious buying volume or positive developments in the broader market, those bounces will likely be short-lived and weak.

Bull Case: Breakout with Structural Reversal

For the bulls to take control, MEW needs to reclaim some ground. Specifically, it has to break convincingly above both the 7-day and 30-day SMAs and push past that $0.00070 resistance level. This needs to happen alongside healthy trading volume and renewed social media excitement. If whales start accumulating or institutional players show interest, that could provide the spark needed. In this more optimistic scenario, price targets around $0.0010 become realistic, with potential upside reaching $0.0018–$0.0025 if everything aligns perfectly. But let’s be clear—this requires both technical confirmation and genuine new catalysts to materialize.

Bear Case: Decline to Deeper Support & Risk of Capitulation

If the broader market turns more risk-averse—say Bitcoin dominance continues climbing or altcoin sentiment collapses further—MEW might not hold at current levels. A breakdown below that ~$0.00050 support could trigger rapid selling toward ~$0.00030–$0.00035, especially if liquidity completely dries up. This risk is particularly acute in the memecoin space, where tokens often lack fundamental utility beyond speculative narratives and community enthusiasm.

Key Metrics & Catalysts to Monitor

If you’re watching MEW, here are the factors that could actually move the needle:

- New exchange listings and partnership announcements that could expand access and bring in fresh liquidity. We’ve seen how previous listings have boosted both trading volume and visibility.

- On-chain activity, particularly whether whale wallets are accumulating or if large holders are moving tokens to exchanges (usually a bearish signal).

- Social media momentum—memecoins live and die by community engagement. Spikes in likes, views, retweets, and viral narratives often precede short-term price runs.

- The broader crypto market environment: overall fear and greed levels, Bitcoin dominance trends, and any regulatory developments. Memecoins tend to be the first casualties when risk appetite disappears and the first to pump when sentiment improves.