Recent Developments and Market Sentiment

The Official Melania Meme token has experienced a dramatic fall from grace since its initial launch. After opening above $10 with a market cap in the billions, the token has crashed by over 90%, leaving investors reeling. The collapse has been fueled by massive sell-offs from the team, a lack of any real utility, questions about how the project is run, and the regulatory minefield that comes with politically-themed meme coins. All of this has created a narrative of pure speculation and possible insider manipulation that continues to drag the price down.

Right now, MELANIA is trading at around $0.12296 USDT, down about 4.63% in the last 24 hours. The daily charts paint a pretty bleak picture—the price is stuck below all the important moving averages, which tells us the bears are firmly in control. Volatility is still running hot with daily swings around 10-11%, meaning this thing can move violently in either direction without much warning.

Technical Indicators and Key Levels to Watch

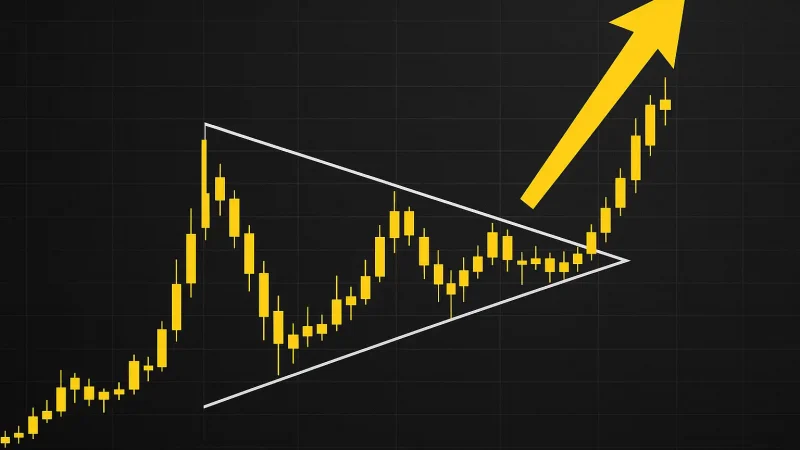

When you look at the momentum and trend indicators, the warning signs are everywhere. The daily RSI is sitting in the low-to-mid 40s—neither oversold nor particularly bullish—while the MACD remains negative with no sign of a bullish crossover on the horizon. The ADX confirms we’re in a strong downtrend. Support appears around $0.1165 and $0.1139, with another weaker level near $0.1112. On the upside, resistance shows up at roughly $0.1343, followed by tougher barriers around $0.1372 and $0.1450. Given how far below the moving averages we are right now, any attempt at recovery will face serious headwinds at these levels.

Zooming out to the weekly chart, MELANIA looks oversold—the RSI has dipped toward or below 30, and the price is bouncing around inside wide volatility bands. That said, momentum indicators like the MACD and CCI aren’t showing clear reversal signals yet. This suggests that while a bounce is possible, it’s going to take something substantial to actually turn this ship around.

Fibonacci Retracements & Moving Averages

Looking at the recent swing from roughly $0.2238 down to $0.0902, the key Fibonacci levels tell an interesting story. The 38.2% retracement sits around $0.1728, the 50% level is near $0.1570, and the 61.8% comes in at about $0.1412. Any meaningful bounce would first need to tackle resistance at the 23.6% level around $0.1923, though that seems pretty far-fetched right now without some major catalyst. All the moving averages—from the 20-period all the way to the 200-period—are sitting above the current price, acting like a ceiling and reinforcing just how bearish the structure is.

Price Prediction Scenarios and Risk Assessment

Bearish Base Case: If the current problems continue—team dumping, no utility, regulatory uncertainty—MELANIA will likely drift lower toward that $0.11 to $0.12 support zone. If it breaks below $0.1112, we could see an acceleration down to $0.07 or even $0.09, particularly if liquidity dries up or more exchanges decide to delist it.

Neutral/Recovery Case: If the broader crypto market improves and bargain hunters step in to take advantage of oversold conditions, a modest bounce to $0.14-$0.15 is within the realm of possibility. Breaking through that 50% Fibonacci level around $0.1570 or getting above the 50-period moving average near $0.1387 would be important technical confirmations for any sustained recovery. Still, the upside looks pretty limited unless we see actual volume and genuine use cases emerge.

Upside Catalyst Case: For MELANIA to make a serious run, we’d need significant positive developments—regulatory clarity, strong endorsements, or real utility being built into the project. Under that kind of scenario, we might see a push toward $0.18-$0.20, but honestly, that seems pretty unlikely without fundamental changes in how the project is managed and a restoration of investor confidence.

Implications for Investors and Traders

Bottom line: with the strong downtrend, high volatility, and price sitting below every major moving average, MELANIA is a high-risk play with limited near-term upside. Short-term traders might find opportunities catching bounces off support levels, but you’d better have tight stop-losses in place. For anyone thinking about holding this longer term, keep a close eye on what the insiders are doing, any governance updates, and especially regulatory news—political meme coins are under intense scrutiny right now.

Unless sentiment shifts dramatically or a legitimate use case materializes, MELANIA looks more likely to continue bleeding than to stage a meaningful recovery in the near term. Sure, it might bounce from oversold levels, but any real reversal will require breaking through layers of bearish technical structure that have built up across multiple timeframes.