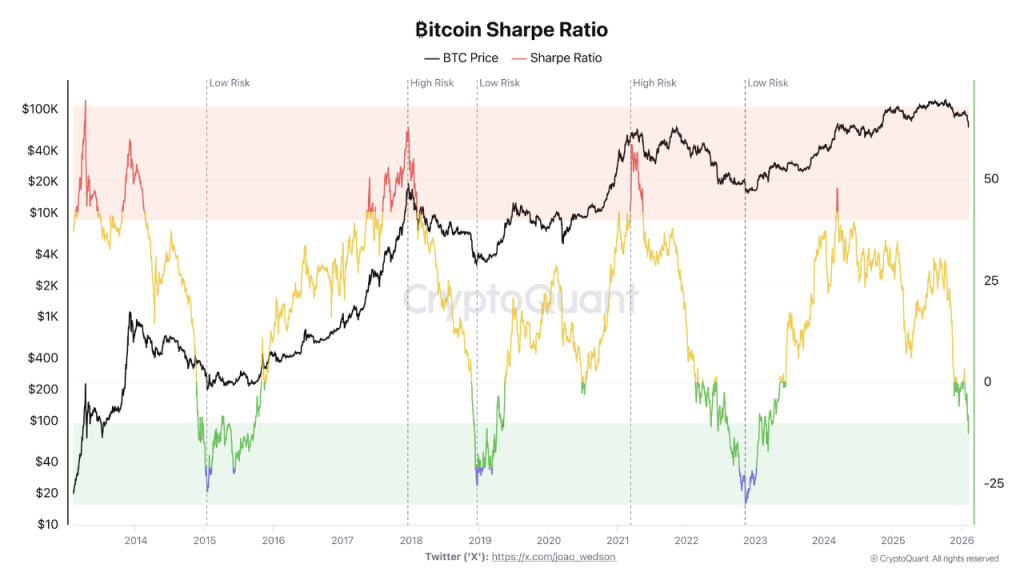

Bitcoin’s resurgence toward $69,000 after scraping lows near $60K brings optimism—but underneath the surface, market metrics tell a more complicated story. Amid political headlines electrifying the financial sector, former U.S. President Donald Trump’s formal nomination of Kevin Warsh as Federal Reserve Chair has emerged as a potential macro catalyst for risk assets. But while traditional markets begin speculating on policy shifts, the crypto market faces a contradictory signal: the Sharpe Ratio, a key risk-adjusted performance indicator, is flashing warnings last seen near prior bear market troughs.

Sharpe Ratio Slumps into Historic Bear Zone

Despite Bitcoin’s latest bounce, the Sharpe Ratio—a metric that weighs return against volatility—continues to deteriorate, plunging into zones historically associated with prolonged bear market behavior. According to data from multiple market analysts, this descent isn’t a sign of immediate capitulation but a reflection of compounding stress within investor positioning. Historically, when Sharpe levels trend below threshold levels for extended periods, it implies risk is rising faster than reward, eroding the viability of short-term bullish narratives.

This isn’t just academic concern. As the ratio declines, it reveals deepening inefficiencies in BTC’s recent performance. Investors are bearing more turbulence while reaping less return, a condition that not only stresses portfolios but eventually flushes excess leverage. These contractions often precede accumulation phases characterized by reduced speculation and longer-term holders gradually increasing control of the float.

Technical Outlook Anchors Around $48K as Structural Drift Deepens

From a price action standpoint, Bitcoin appears to be navigating a precarious technical landscape. After respecting the $78,000 zone—corresponding to the 0.382 Fibonacci retracement from the cycle top near $126,000—the market lost upward momentum and re-entered a drifting structure. This technical weakness now points toward potential attraction around $48,000, the 0.618 retracement level that has historically acted as a magnet during prolonged consolidations.

For momentum traders, this zone serves as both a psychological and technical pivot: a breach below $52,000 could open the gateway toward a complete retest of $48K, a level that may finally provide enough structural support for stabilization. Importantly, this pullback does not signal long-term failure—it reflects reversion toward zones where risk premium becomes acceptable again as speculative excess evaporates.

Contrarian Sentiment Builds Beneath the Surface

Interestingly, this backdrop of rising stress in risk metrics may be quietly setting the stage for future resilience. Historically, extreme negative Sharpe readings—particularly during macroeconomic uncertainty—have aligned with contrarian opportunity zones. These don’t indicate immediate reversals but suggest the start of a landscape where smart money begins to position long-term, uncrowded trades.

That said, investors should not misinterpret these signals as a green light. In periods of macro and policy transition—especially one influenced by a potential Warsh-led Fed—markets often grind sideways for longer than expected. The absence of forced bullishness can be a positive, indicating the unwinding of froth rather than fear-driven exits. This subtle shift creates breathing room for fundamental value to reassert itself.

What a Kevin Warsh Fed Could Mean for Crypto

Warsh is widely seen as a market-friendly figure, known for his advocacy of clear communication and a more rules-based monetary policy. Markets may interpret his nomination as a sign that rate hikes could pause earlier than expected—or that the Fed might adopt a less interventionist approach, letting free-market dynamics play out. If realized, this would affect risk appetite across asset classes.

In crypto, which straddles volatility and innovation, such a shift could be dual-edged. Lower interest rate expectations might buoy BTC and ETH, but if tightening stops short due to systemic fragilities, capital flows might get rerouted into defensive sectors before returning to high-beta plays like crypto. The net result could be a slow grind upward driven more by structural reforms than euphoric inflows.

Risk and Patience: The Strategies Now Diverging

For BTC positioning, the strategic divide is becoming clearer. Some investors are opting for gradual accumulation at historically lower Sharpe territories, betting that long-term upside remains unchanged. Others demand clearer confirmation—both in the price structure and risk backdrop—before scaling exposure.

Either path underscores a shared conclusion: urgency is misplaced. The next phase for BTC, ETH, and even XRP will likely be shaped not simply by headlines or price swings, but by the slow recalibration of investor tolerance for volatility relative to reward. In that sense, the Sharpe Ratio is not merely an indicator—it’s a mirror reflecting investor psychology in real time.

While short-term fluctuations remain likely, and a dip toward $48K remains technically plausible, the broader architecture is gradually favoring accumulation over euphoria. If Kevin Warsh does take the helm of the Fed, and if markets begin recalibrating expectations around liquidity and macro stability, crypto could find a fertile ground for its next chapter—but patience will be the cost of entry.