Bitcoin’s recent retreat below the $91,000 threshold has reignited concerns across the cryptocurrency markets. While price fluctuations are nothing new in this space, the current conditions tell a more complex story than a simple market dip. Beneath the surface, a potentially worrisome cocktail of rising open interest, persistent bullish leverage, and lackluster liquidations point toward a deeper correction looming just beyond view. As the crypto community watches closely, the data reveals subtle signs that this isn’t yet a bottom—it might just be the eye of the storm.

BTC Struggles to Hold $91K as Bears Tighten Grip

Over the past several sessions, BTC has been forming a string of lower highs and lower lows. The price, currently hovering around $90,865, reflects a 2.6% daily decline and a seven-day stretch dominated by red candles. This continued weakness has pushed the token toward familiar territory—near its 50-day moving average and a key structural support around $90,400. If this level fails, BTC risks dipping into the critical support band between $86,400 and $86,700, an area that historically sparked heavy buyer interest—but this time, it may not hold.

Technicals confirm a troubling shift in momentum. Trading volume remains elevated, yet buyer dominance has visibly faded. Additionally, price action now hugs the lower boundary of a rising channel that carried Bitcoin from sub-$80K levels earlier this year. This flirtation with structural support, combined with weakening upside conviction, could invite aggressive downside pressure—especially if derivatives markets remain frothy.

Leverage Metrics Hint at Hidden Risk Across Derivatives

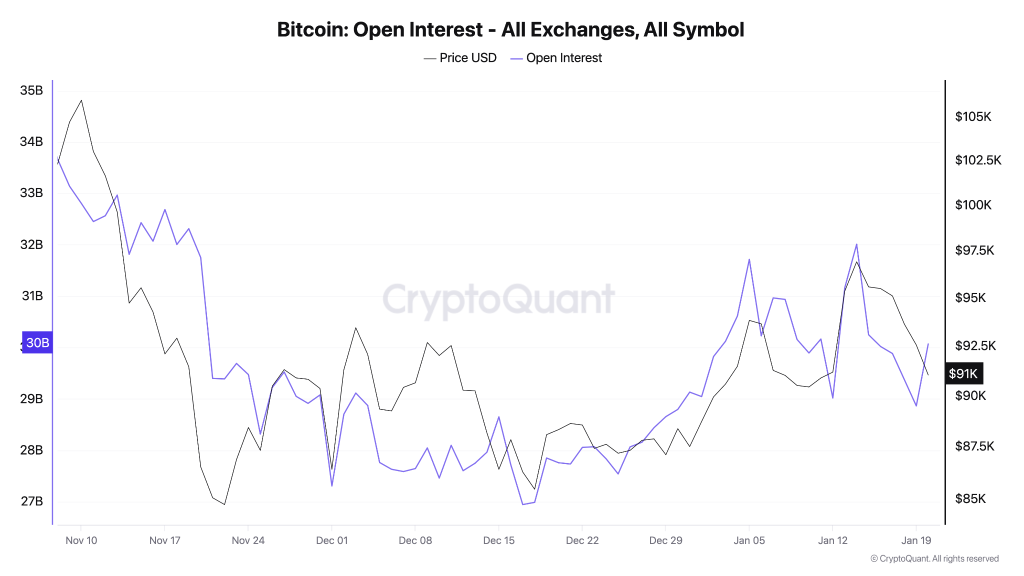

Unlike organic price corrections driven by fundamental re-evaluations, this recent BTC pullback appears tangled with lingering leverage. Derivatives data reveals a concerning backdrop: open interest is rising in tandem with falling prices—an uncommon pairing that suggests speculative traders might be reloading rather than retreating. In bear markets, flowing leverage into declining prices often precedes sharp volatility events, where cascading liquidations sweep across over-leveraged positions.

Open Interest Climbing Despite Price Decline

On-chain and exchange aggregate data confirm that Bitcoin’s open interest has expanded despite its downward trajectory. This means an increasing number of futures contracts are being opened or held as price sinks—a sign that participants continue betting with leverage instead of closing risk. This “risk-on” behavior during a downturn signals market complacency and raises the chance of a liquidation cascade if pressure escalates.

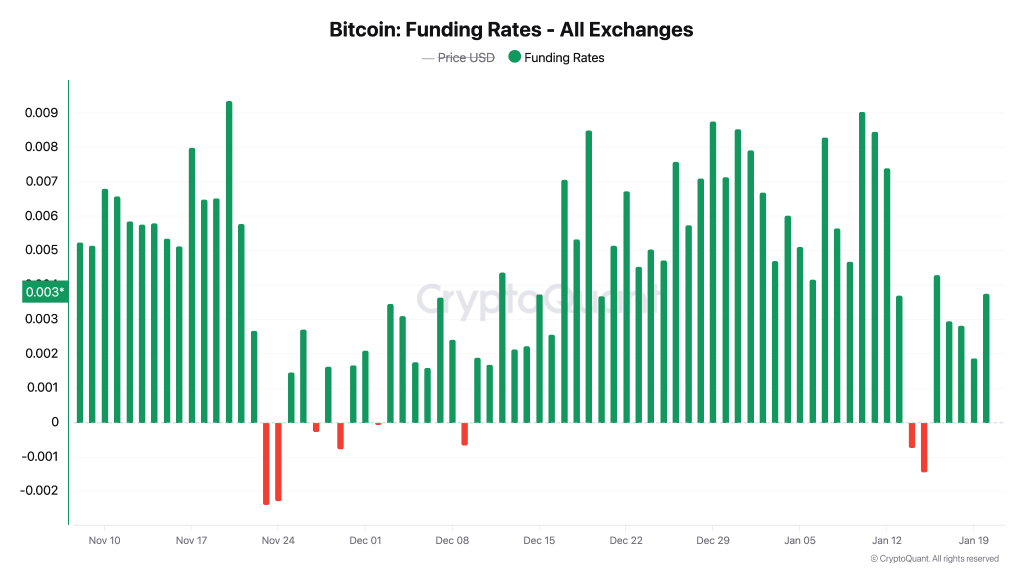

Positive Funding Rates Suggest Bullish Bias Persists

Compounding the risk is the positive perpetual swap funding rate, which currently sits around +0.003. A positive funding environment implies long traders are willing to pay shorts to maintain positions—effectively betting on rebound. This optimism, while common in uptrends, becomes a liability when prices are declining. In true corrections or capitulation phases, funding rates typically flip negative as bulls retreat and bears dominate. The persistence of bullish funding despite price erosion suggests the market hasn’t fully reset—yet.

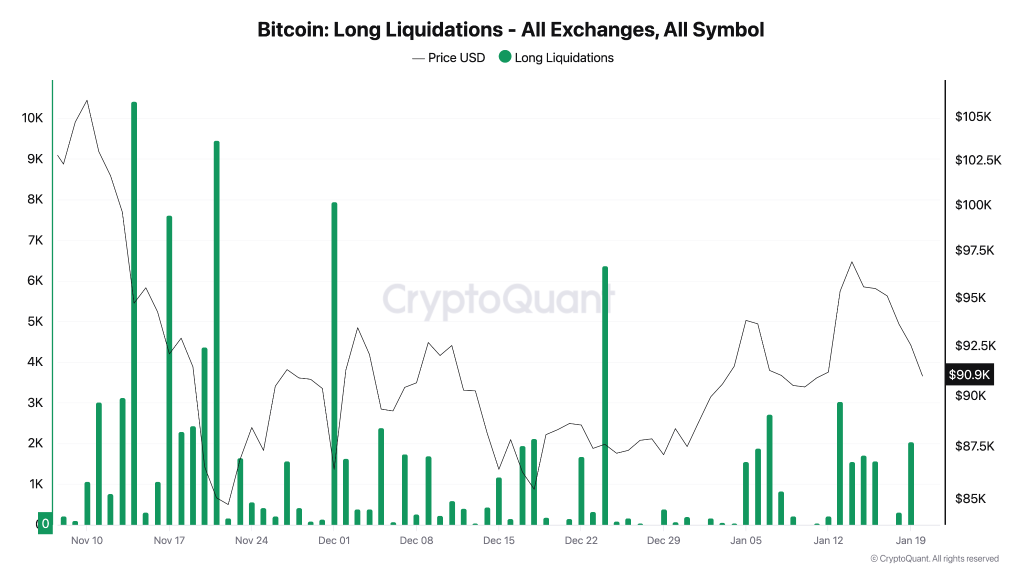

Liquidations Remain Muted, Undermining Capitulation Narrative

Perhaps most telling is the muted level of long liquidations. Recent sessions have seen approximately 2,000 long-side contracts wiped out—far lower than past events that generated true market flushes, where liquidation tallies surged beyond 10K. These relatively benign figures imply that while Bitcoin’s price is down, aggressive leverage hasn’t yet been purged. In simple terms: we haven’t seen panic. Until broader liquidations force out the longs, it’s difficult to argue the market has found a resilient bottom.

Support Boundaries Are Tight, But Sentiment is Still Eroding

With Bitcoin precariously balanced above its 50-day moving average and a fragile demand zone between $86.4K and $86.7K, the next few days could define the short-term trend. A decisive breakdown below this support could usher in a round of reactive selling—and perhaps, finally, flush lingering leverage from the market. Conversely, a strong bounce aided by macro momentum might allow BTC to reclaim the $98K resistance and re-target the $100.6K–$110.7K range. But for now, sentiment data implies bears maintain the upper hand.

Until derivatives cool off, funding neutralizes, and we see meaningful liquidations that wipe out excess leverage, any recovery may be short-lived. Traders would do well to watch the interplay between price levels and these secondary metrics—not just the charts. In this market phase, it isn’t just about where Bitcoin is—it’s about who’s still onboard and how risky the ride has become.