Market Context and Short-Term News Catalysts

Right now, BRETT/USDT is trading around $0.01451016, down about 0.38% over the last 24 hours—nothing too dramatic, just a minor pullback. The token has become one of the hottest talking points among meme coin enthusiasts on the Base blockchain, fueled mostly by retail buzz and passionate community support. There haven’t been any groundbreaking protocol updates or regulatory bombshells in the past day, but technical analysis shows some concerning signs of weakening momentum despite generally positive signals from moving averages. This creates an interesting split: some traders see this as BRETT gearing up for a bounce, while others worry it might be overextended or just consolidating. Trading volume has cooled off a bit, and volatility indicators like ATR suggest the market is in a wait-and-see mode.

Technical Indicators & Key Supports/Resistances

When you dig into the charts, you’ll find a somewhat mixed picture that leans slightly bearish in the short run, even though longer-term moving averages look more encouraging. The 5-day and 10-day moving averages are sitting below the current price, which means there’s support forming around the $0.01400–$0.01410 level. But here’s the catch—BRETT is still trading under its 50-day and 200-day moving averages, both simple and exponential, which tells us the medium-term trend hasn’t fully turned bullish yet.

Looking at oscillators, the RSI is hovering in neutral territory around 40-50, so we’re not seeing extreme oversold or overbought conditions. The MACD is pretty flat right now, though there are hints of bullish momentum creeping in. Meanwhile, Williams %R and CCI are flashing short-term oversold signals, which could mean we’re approaching a good bounce zone. On the support side, watch the **$0.01430–$0.01445** range for immediate support, with a stronger safety net around **$0.01280–$0.01300** if things get uglier. Resistance is showing up at **$0.01460–$0.01475**, and if bulls really get going, the **$0.0180–$0.0200** zone becomes the next major hurdle.

Short-Term Trading Scenarios

If BRETT can hang onto the $0.01445 level and the broader crypto market stays calm, there’s a decent chance we’ll see a bounce toward **$0.01475–$0.01480**. Breaking cleanly above that zone would open the door to test the **$0.018–$0.020** resistance area. On the flip side, if support at $0.01430-$0.01445 gives way, the next stop is likely around **$0.01300**, with **$0.01280** possible if selling pressure intensifies. For swing traders looking for better entries, that lower zone might offer a more favorable risk-reward setup.

Mid-to-Long-Term Outlook & Price Predictions

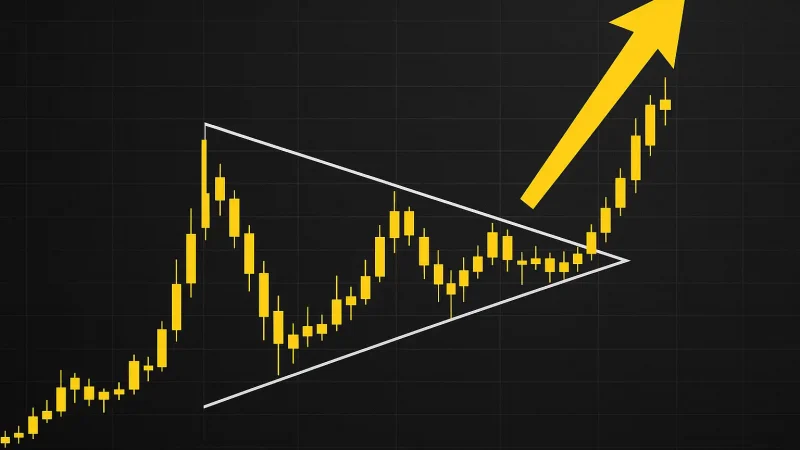

Zooming out to weekly and monthly charts, BRETT is clearly stuck in consolidation mode. It’s been trading below both the 50-period and 200-period moving averages, which means the long-term trend hasn’t officially flipped bullish. That said, these moving averages are starting to flatten out, and indicators like ADX suggest momentum could build if price manages a decisive break above resistance.

Looking ahead 3-6 months and assuming the Base network continues growing, a reasonable target would be the **$0.0200–$0.0250** range—but only if BRETT breaks through intermediate resistance and volume picks up. In a more optimistic scenario—think major exchange listings, new platform features, or DeFi partnerships—we could see prices push toward **$0.0300–$0.0350**. Of course, that’s a tall order requiring not just technical breakouts but real improvements in sentiment and capital flows. On the bearish side, especially if crypto markets turn sour, we might revisit $0.0120 or even lower.

Investor Implications & Risk Management

For anyone thinking about jumping in: the risk-reward here is interesting but not without danger. There’s genuine upside potential if support holds and resistance breaks, but there’s also real downside if key support levels fail. If you’re going long, consider placing stop-losses just below $0.01430, and think about taking some profits near resistance zones rather than betting everything on a moonshot. Given that volatility is still pretty high and sentiment in the meme coin space can flip on a dime, position sizing matters more than usual here.