Current Market Snapshot and News Context

Osaka Protocol (ticker OSAK/USDT) is currently trading at around 4.8 × 10⁻⁸ USD according to recent data from CoinMarketCap. The circulating supply sits at roughly 7.51×10¹⁴ OSAK tokens, while the total supply is capped at about 1×10¹⁵ tokens. Market capitalization hovers between $35–$37 million USD, though the 24-hour trading volume tells a different story—coming in at less than $15,000. This extremely low liquidity means even small trades can create significant price swings. Over the last day, the token has dropped somewhere between 3–4%, though you might see different numbers depending on which platform you’re checking.

As far as news goes, Osaka Protocol still gets lumped in with other meme-tokens in the Solana ecosystem. Most of the attention it receives comes from its tokenomics structure and community involvement rather than any groundbreaking partnerships or tech upgrades. The token hit its all-time high back in April 2024 at around $6.43×10⁻⁷ USD—a peak it hasn’t come close to touching since then.

Technical Indicators & Price Structure

Looking at the technical picture from various analysis sites, OSAK/USD is showing a pretty mixed outlook on both daily and weekly charts. Moving averages across different timeframes—from MA5 all the way to MA200—are basically split down the middle. You’ll see about half giving buy signals and half giving sell signals, which really just tells us the market doesn’t have a strong opinion right now.

Here’s what the other technical indicators are saying:

- The Relative Strength Index (RSI) is sitting around 50–52, which puts it squarely in neutral territory. It’s not screaming oversold and ready to bounce, but it’s not overbought either.

- The Stochastic and StochRSI indicators are showing overbought readings in shorter timeframes, which might mean the upside momentum is running out of steam unless something changes soon.

- The ADX (Average Directional Index) is reading fairly strong—above 60 in some analyses. This suggests that when the price does decide to make a move, it could be a decisive one. The problem is, right now it’s mostly moving sideways.

Support, Resistance, and Potential Price Scenarios

Based on what we’re seeing in the charts and pivot point analysis, here are the key levels to watch:

- Support zones are clustered around $4.5×10⁻⁸ to $5.0×10⁻⁸ USD. This range has been holding up pretty well in recent sessions and is absolutely critical for maintaining the current price level. If this floor breaks, we could see a quick slide down to the $3–4×10⁻⁸ range.

- Resistance areas are sitting at roughly $7.0×10⁻⁸ USD and higher. This is where sellers have stepped in before. Breaking through this level—especially with strong volume backing it—could open the door to $9.0×10⁻⁸ or even higher targets.

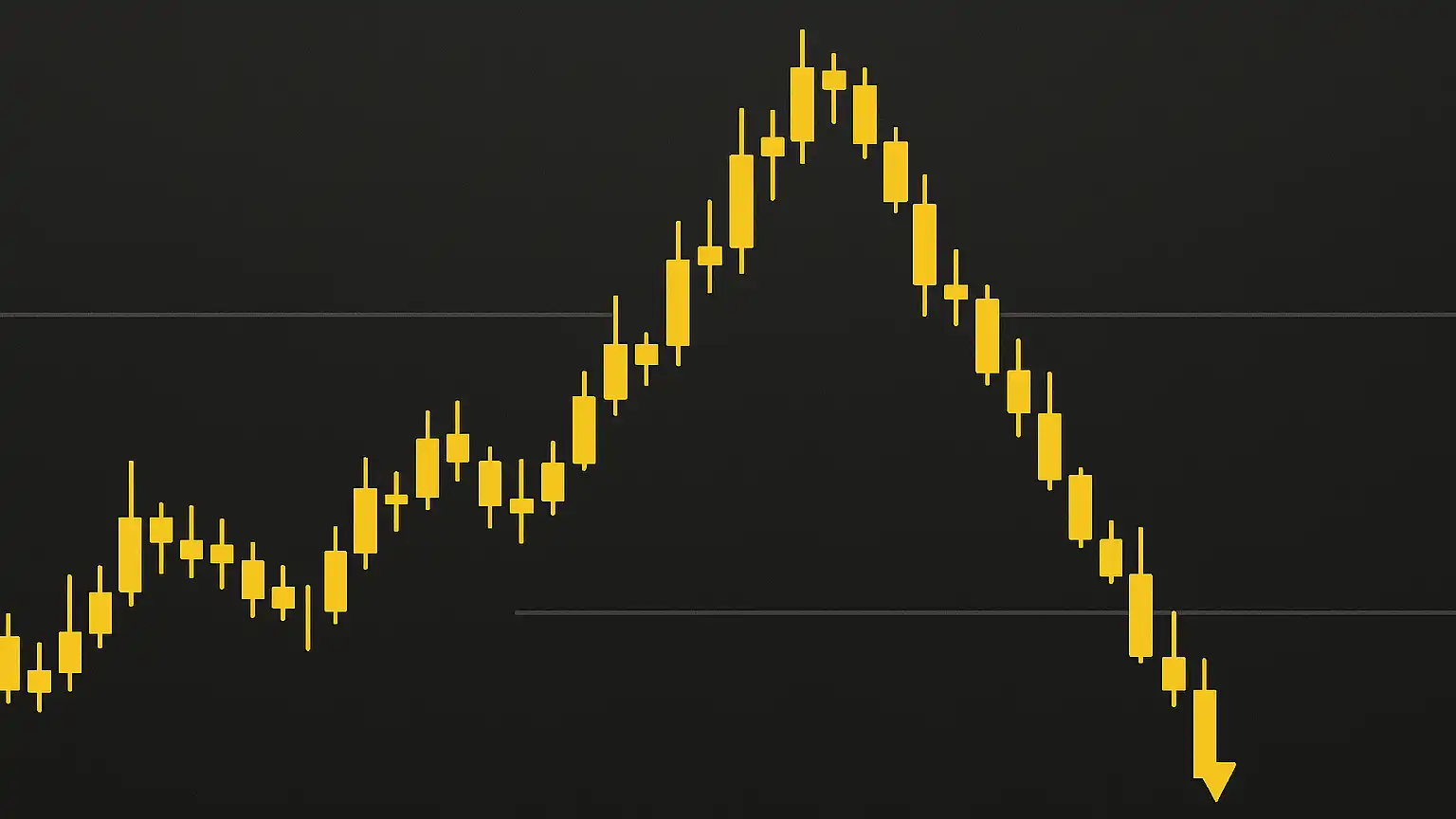

Bearish Case

If selling pressure starts building up—whether from short sellers or whales looking to exit—the price could easily slip below that critical support zone. And here’s where the low liquidity becomes a real problem: it could amplify the downward movement, potentially sending the price tumbling fast to $3.0×10⁻⁸ USD or lower. The technical indicators aren’t showing any strong bullish divergence at the moment, so it would take a clear breakout or a significant volume spike to turn things around. The MACD is pretty flat and neutral, not giving much confidence for an upside move.

Bullish Case

On the flip side, if OSAK can hold support above $5.0×10⁻⁸ USD and manage to push above $7.0×10⁻⁸ with decent volume behind it, things could get interesting. The next resistance level would come into play around $9–10×10⁻⁸ USD. In this scenario, we’d likely see the moving averages start aligning more positively, and momentum indicators like RSI and Stochastic would move into zones that confirm bullish momentum. Breaking above the $1×10⁻⁷ USD psychological level could really catch people’s attention and bring in new buyers.