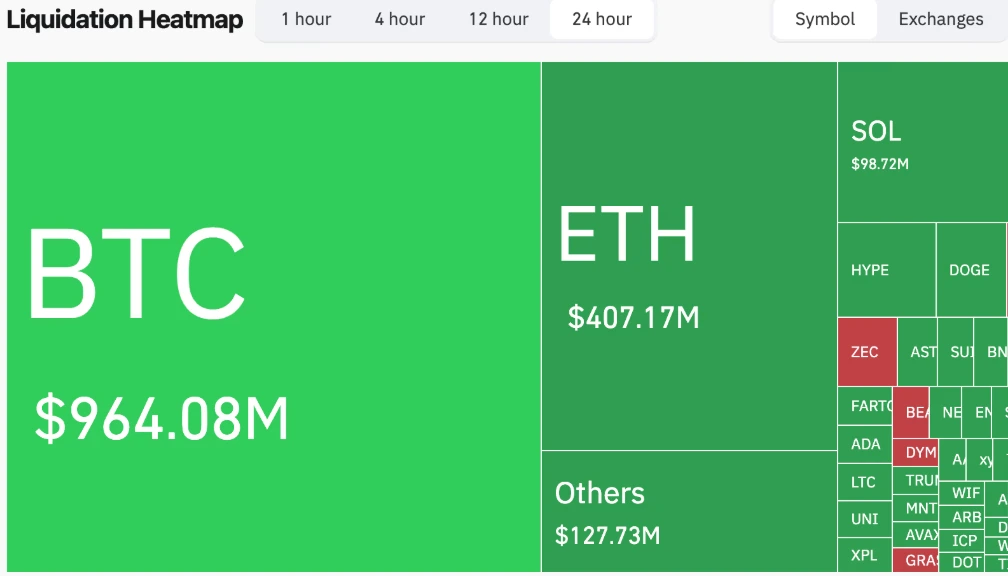

On November 21, 2025, the cryptocurrency market witnessed one of its most violent shakeouts in recent memory. Nearly $2 billion worth of leveraged positions were liquidated within a single, volatile 24-hour window—putting close to 396,000 traders underwater and shattering records along the way. Bitcoin led the descent, shedding nearly 9% in value during the worst of the crash, while Ethereum and Solana followed, hemorrhaging over 10% in mere hours.

Yet even as positions disappeared en masse, many traders did not. Contrary to historical patterns, participants in this wipeout opted to stay in the market. Their behavior reveals an industry undergoing quiet evolution—where leverage still stings, but no longer demands retreat.

November’s Cascading Liquidations Signal the Return of Fear

The selloff was reportedly triggered by a mix of declining bullish sentiment and growing macroeconomic ambiguity. Bitcoin plunged from $92,000 toward intraday lows around $80,600–$81,600 before bouncing slightly to rest around $84,500. Ethereum wasn’t spared, tumbling from above $3,000 to as low as $2,703—a 10%+ decline—while Solana saw a comparable plummet past key technical support areas.

The data from Coinglass was striking. The Crypto Fear & Greed Index—a composite measure of sentiment—cratered to 11, echoing panic levels not seen since the collapse of FTX in November 2022. Yet the unique character of this decline wasn’t merely in its speed or scale, but in how hardened the speculative class had become.

Mass Liquidations, But Waning Capitulation

Historically, events like November’s would trigger a large-scale exit from leveraged markets, especially visible in plummeting open interest. Not this time. CoinGlass data showed a 17% drop in open interest from late October into the height of the selloff, particularly among major exchanges such as Binance, OKX, and Bybit. But something changed post-crash: open interest stopped falling. Price and trader enthusiasm diverged.

Many chose to stay. After the initial shock, open interest moved sideways through late November, a notable contrast with prior wipeouts such as the October 10 crash that saw a 37% drawdown in open interest and widespread market disengagement. The implication? Traders are becoming more sophisticated, more deliberate, and more reluctant to abandon positions during stress—hinting at foundational maturity in speculative behavior.

Growing Risk Intelligence Among Traders

Another piece of the puzzle comes from behavioral data. According to Leverage.Trading’s November 2025 Risk Report, susceptibility to liquidation far outpaced losses in trader participation. Platform metrics indicated increased usage of risk-management tools during the drop: more traders checked margin calls, calculated liquidation thresholds, and monitored funding rates in real-time.

The shift reflects a structural change in how leverage is approached. Rather than panic selling or abandoning exposure, traders are increasingly resetting risk mid-stream. Notably, funding rates—once persistently elevated in bullish times—turned negative throughout late November. This trend made it less costly to maintain long positions even during declines, further discouraging mass exit and indicating strategic recalibration, not just fear.

Ethereum and Altcoins: Not Immune, But Not Abandoned

While Bitcoin absorbed most of the spotlight, Ethereum positions bore heavy losses, too. On November 21, over $400 million in ETH longs were liquidated, particularly near $2,700 levels—a zone dense with stop-loss clusters. Solana, often celebrated as a multi-cycle outperformer, followed with $100 million in liquidations near $122, where market speculation had recently clustered.

But again, post-liquidation positioning remained surprisingly steady. Traders appeared to anticipate the shock, with funding rate declines and market-making models already adjusted for volatility. It reinforces the idea that today’s crypto market is less driven by speculative abandon, and more by systems increasingly modeled after traditional finance—tempered, risk-aware, and highly reactive.

Beyond the Shakeout: What the Market Learned

November’s leverage wipeout was statistically destructive, but strategically revealing. In prior years, such an event might have presaged months of declining open interest, enthusiasm, and trader numbers. This time, it may have simply pruned excess. With funding costs resetting and margin behavior evolving, derivatives participants showed new levels of strategic endurance.

The key takeaway? Leverage is still woven into the DNA of crypto trading, but it’s increasingly wielded with foresight. Rather than a market teetering on the edge of unsustainable excess, this data paints a picture of a still-speculative industry undergoing careful reengineering. As crypto continues to mature, such micro-shocks may no longer signal systemic fragility—but rather resilience in the face of chaos.